GAMBRELL FINANCIAL NEWS

What’s the “True Cost Of Home Ownership”

Many people rush to purchase a home without really considering the actual cost of owning the home. Most people only consider the P&I when calculating affordability as if the other expenses are voluntary.

NEWS FLASH-The extra expenses are not voluntary!

TOP-RATED FINANCIAL NEWS

Don’t have time to read, you can listen to our podcast at: https://www.redzonetoolbox.com/

Have a topic you would like more clarity on send us an email: [email protected]

What's the "True Cost Of Home Ownership"

What’s the “True Cost Of Home Ownership”

Many people rush to purchase a home without really considering the actual cost of owning the home. Most people only consider the P&I when calculating affordability as if the other expenses are voluntary.

NEWS FLASH-The extra expenses are not voluntary!

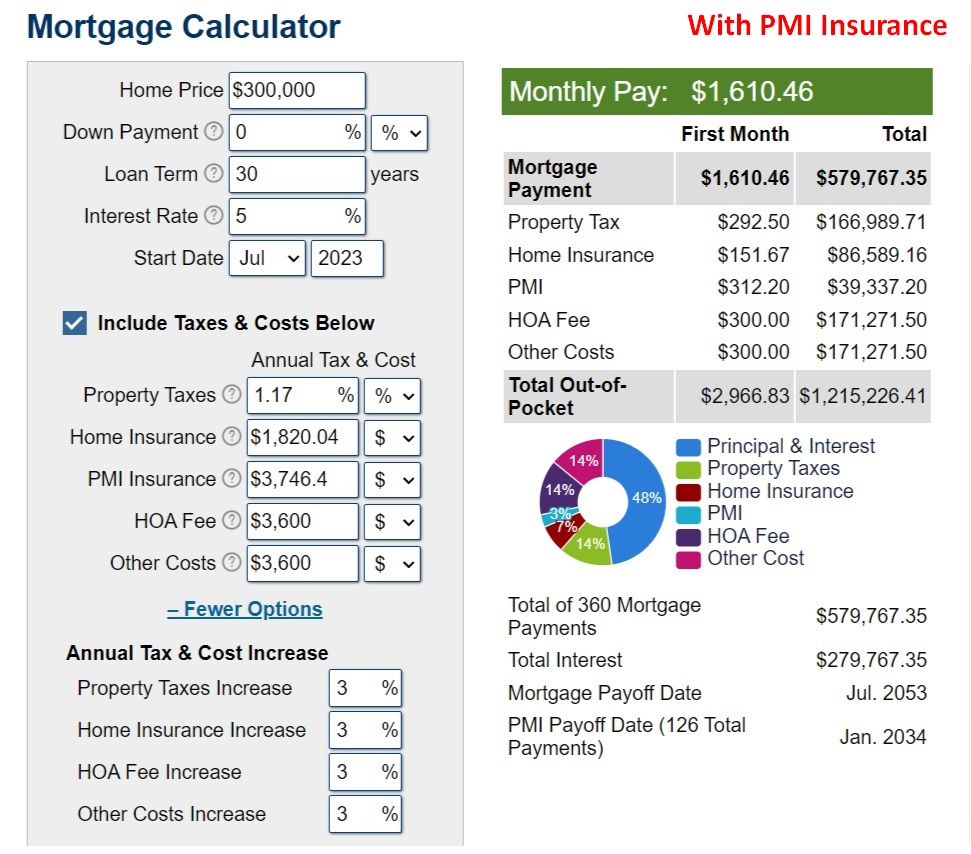

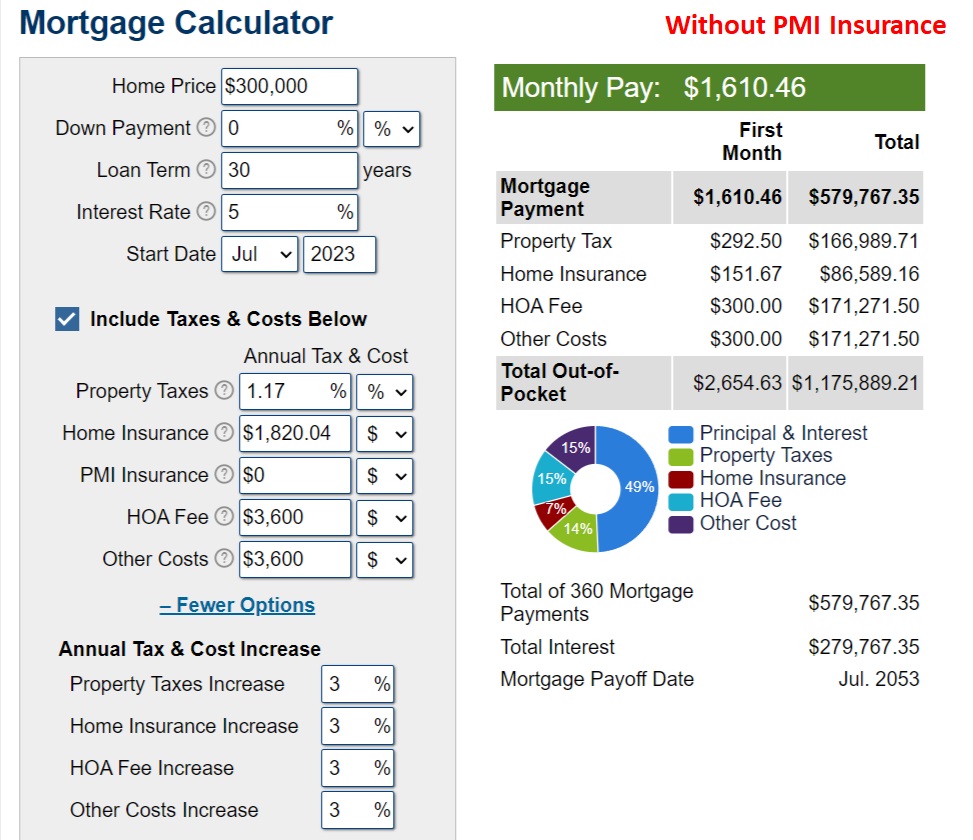

Using a $300,000 home sale in this example, let’s look at the true cost of ownership.

$300,000 Home assuming zero down.

30-year term

5% fixed rate

$1,610.46 P&I

However

$2,967.13 is what you should factor in as your total monthly cost of homeownership! (Starting off)

$300,000 Home assuming zero down.

30-year term

5% fixed rate

$1,610.46 P&I

$292.50 Property Tax 1.17% (3% Annual Increase)

$151.67 Homeowners Insurance (3% Avg Annual Increase)

$312.20 PMI Insurance (No money was put down)

$300 HOA Dues (3% Avg Annual Increase)

$300 Average Maintenance Cost (3% Avg Annual Increase)

Grand Total

$2,967.13 Monthly

Totals Breakdown

$300,000 Total paid for principal.

$279,767 Total paid in Interest.

$86,587.26 Total paid for Homeowners Insurance

$39,375.00 Total paid for PMI (drops off after around 10 years)

$166,989.71 Total Paid for Property Tax

$171,271.50 Total paid for HOA Fees

$171,271.50 Total paid for Other out of pocket -maintenance expenses.

Total 30 year out of pocket Homeownership costs:

$1,215,261.97

We assumed the home would grow in value at an average of 3% in this scenario.

After 30 years with an average growth of 3% the home would be worth… $728,178.74

$1,215,262.31 is the amount you will pay over 30 years to own a $300,000 home.

With many homeownership scenarios simply multiply the principal by 4 to figure out the total 30-year cost of ownership…. As you can see with this example the numbers are slightly higher.

In this rent scenario I’ll use the same payment as the P&I calculation on a $300,000 home at 5%.

Our rent payment in this example will be the same as our P&I payment: $1,610.46.

$635,495.31 is the total of non-P&I expenses. The non-P&I expenses will be invested over 30 years.

If we pay $1,610.46 monthly for rent over 30 years, the total will equal the same as our P&I $579,767

After adjusting for the rental rate increase, we’ll add an additional $95,400 for a total 30-year rent balance of $675,167.

We’ll subtract this total from our 30 year all in cost.

This leaves us with $1,500.26 to be invested each month for 30 years.

We simply took $1,215,262.31 – $675,167 (total rent cost) = $540,095.31 / 360 months = $1,500.26

As a result of the taxes, maintenance fees, HOA fees, PMI, Homeowners insurance, you’ll pay an average of $1,500.26 extra each month for 30 years versus the rent scenario.

If we invest this amount ($1,500.26) each month for 30 years our ending account value would be $3,180,017.94 assuming a 9.62% rate of return.

The homeownership route would leave you with a home worth $728,178.74 assuming a growth rate of 3% after paying $1,215,262.31 to own the home.

The rent option would provide you with $3,180,017.94 more than the homeownership option.

But in all fairness lets subtract the value of the home!

$3,180,017.94 – $728,178.74 = $2,451,838.20.

There comes a point when a home will not continue a steady growth cycle. This could be due to an aging neighborhood, community crime rate because of the aging neighborhood, newer housing communities built around the older housing communities etc…

What I’m going to do is add back in the growth of the purchased home to bring us back to $3,180,017.94.

With this pot of money we’ll purchase a current value new home for $500,000 using a HECM for purchase loan.

With the HECM for purchase loan we’ll spend $289,000 to secure the $500,000 home and never make another payment again.

With the renters’ option we end up purchasing a home for $500,000 but only have to spend $289,000 leaving us with almost $3 Million in the bank, $2,891,017.94 living in a current new home with no mortgage and principal payments owed!

I’ll let you decide which scenario is the winner.

The original homeownership scenario paying $1,215,262.31 to have a home worth $728,178.74 which is less than what your total all in costs are!

Or paying $675,167 (total rent cost) followed up with a new home purchase of $500,000 but only spending $289,000 along with $2,891,017.94 in the bank!

The Mortgage Calculator I Used*

https://www.calculator.net/mortgage-calculator.html?chouseprice=300%2C000&cdownpayment=0&cdownpaymentunit=p&cloanterm=30&cinterestrate=5&cstartmonth=7&cstartyear=2023&caddoptional=1&cpropertytaxes=1.17&cpropertytaxesunit=p&chomeins=1%2C820.04&chomeinsunit=d&cpmi=0&cpmiunit=d&choa=3%2C600&choaunit=d&cothercost=3%2C600&cothercostunit=d&cmop=1&cptinc=3&chiinc=3&choainc=3&cocinc=3&cexma=0&cexmsm=7&cexmsy=2023&cexya=0&cexysm=7&cexysy=2023&cexoa=0&cexosm=7&cexosy=2023&caot=0&xa1=0&xm1=7&xy1=2023&xa2=0&xm2=7&xy2=2023&xa3=0&xm3=7&xy3=2023&xa4=0&xm4=7&xy4=2023&xa5=0&xm5=7&xy5=2023&xa6=0&xm6=7&xy6=2023&xa7=0&xm7=7&xy7=2023&xa8=0&xm8=7&xy8=2023&xa9=0&xm9=7&xy9=2023&xa10=0&xm10=7&xy10=2023&printit=0&x=Calculate