GAMBRELL FINANCIAL NEWS

The Zero Percent Tax Bracket!

Eliminate Sequence Of Returns Risk-Longevity Risk & Income Tax Risk During Retirement

Current retirees are spending an average of 31% of their retirement income on taxes. For most retirees’ taxes will be your largest expense with health care at a close #2! Let us eliminate this tax burden by helping you to achieve the zero percent tax bracket.

TOP-RATED FINANCIAL NEWS

Don’t have time to read, you can listen to our podcast at: https://www.redzonetoolbox.com/

Have a topic you would like more clarity on send us an email: info@gambrellfinancial.com

2023 tax brackets: How it works! Helpful information before reviewing the zero percent tax bracket segments..

2023 tax brackets

If you’re single (known as an individual filer), your brackets are:

10 percent: Up to $11,000

12 percent: $11,001 to $44,725

22 percent: $44,726 to $95,375

24 percent: $95,376 to $182,100

32 percent: $182,101 to $231,250

35 percent: $231,251 to $578,125

37 percent: Over $578,125

People who are married but file separately (known as married filing separately) have the same tax brackets as individual filers do until the top two. Those amounts are:

35 percent: $231,251 to $346,875

37 percent: Over $346,875

If you are married and file a single tax return as a couple (known as married filing jointly), your brackets are:

10 percent: Up to $22,000

12 percent: $22,001 to $89,450

22 percent: $89,451 to $190,750

24 percent: $190,751 to $364,200

32 percent: $364,201 to $462,500

35 percent: $462,501 to $693,750

37 percent: Over $693,750

If you are unmarried, pay for more than half your household’s expenses and have a dependent (known as head of household), your brackets are:

10 percent: Up to $15,700

12 percent: $15,701 to $59,850

22 percent: $59,851 to $95,350

24 percent: $95,350 to $182,100

32 percent: $182,101 to $231,250

35 percent: $231,251 to $578,100

37 percent: Over $578,100

The process of calculating one’s tax bracket and effective tax rate is not as straightforward as one might initially think. To begin with, the income specified on a W-2 form is not necessarily the amount that is taxable. After filing, deductions are often taken which can lower an individual’s taxable income. This may include the standard deduction or any other deductions itemized on the tax return. The 1040 form is used to determine one’s taxable income.

Furthermore, the U.S. income tax system follows a progressive tax system, meaning that as an individual’s income rises, so does the percentage of taxes paid. This is done through graduated tax brackets.

For example: If you are single, and after deductions, your taxable income is $50,000, which lands you in the 22 percent tax bracket. You won’t be paying 22 percent on all $50,000 (which would be $11,000 in federal tax). Rather …

- The first $11,000 will be taxed at 10 percent, which is $1,100.

- The income between $11,001 and $44,725 (or $33,725) will be taxed at 12 percent, or about $4,047.

- The income between $44,726 and $50,000 (or $5,274) will be taxed at 22 percent, or about $1,160.

As you can see with this example, your total 2023 federal income tax owed would be $6,307 ($310 less than you would have paid on the same income last year).

Your marginal tax bracket is the tax rate you paid on your last dollar of income and is how you determine which tax bracket you’re in. Your effective tax rate, meanwhile, is the percentage of your income that you paid in taxes after all was said and done — in this case, a little less than 13 percent ($6,307/$50,000).

Your tax bracket and effective tax rate can change yearly. If you received a pay increase in the last year, it could push you into the next higher tax bracket (that’s why the tax brackets also increase over time). The opposite is true if your income drops or you become eligible to take more deductions, you could fall into a lower tax bracket.

This information provided is not intended as legal or tax advice. Consult with a tax professional for tax advice specific to your situation.

Pay zero taxes on your 401k / IRA Distributions During Retirement.

How to pay zero taxes on your 401k or IRA tax deferred accounts.

99% of advisors are not aware of this strategy!

A big part of this strategy revolves around taking the standard deduction.

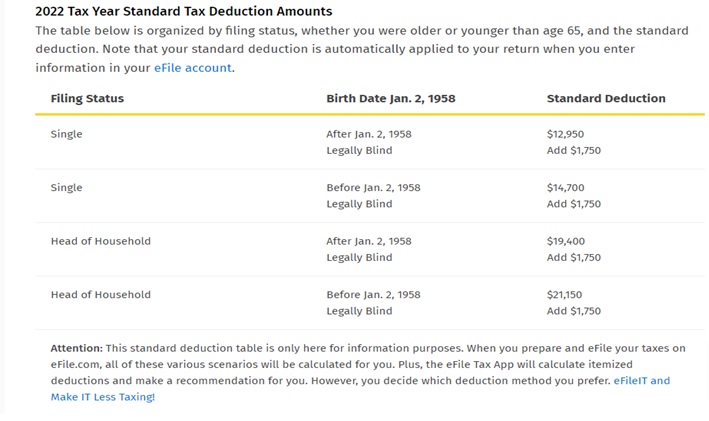

How the standard deduction works:

A married couple aged 65 earns $27,000 in 2023. The current standard deduction for 2023 for this couple is $28,700. This couple uses the standard deduction leaving them with a negative – $1,700 in taxable income.

Take the standard deduction of $28,700 minus the current combined income $27,000 = Negative

-$1,700. Their total income in this example is less than the standard deduction leaving them with ZERO taxes owed, in fact with this scenario this couple might see a tax refund.

If their income was $129,000 taking the standard deduction of $28,700 their total taxable income in this scenario would be $129,000 – $28,700 (the standard deduction) this leaves $100,300 in taxable income.

With the first example ZERO taxes are owed, they’re in the zero percent tax bracket however in the second example a 22% tax would be owed on $100,300.

We have multiple different moving parts with this plan so please be patient as I set the stage for this strategy!

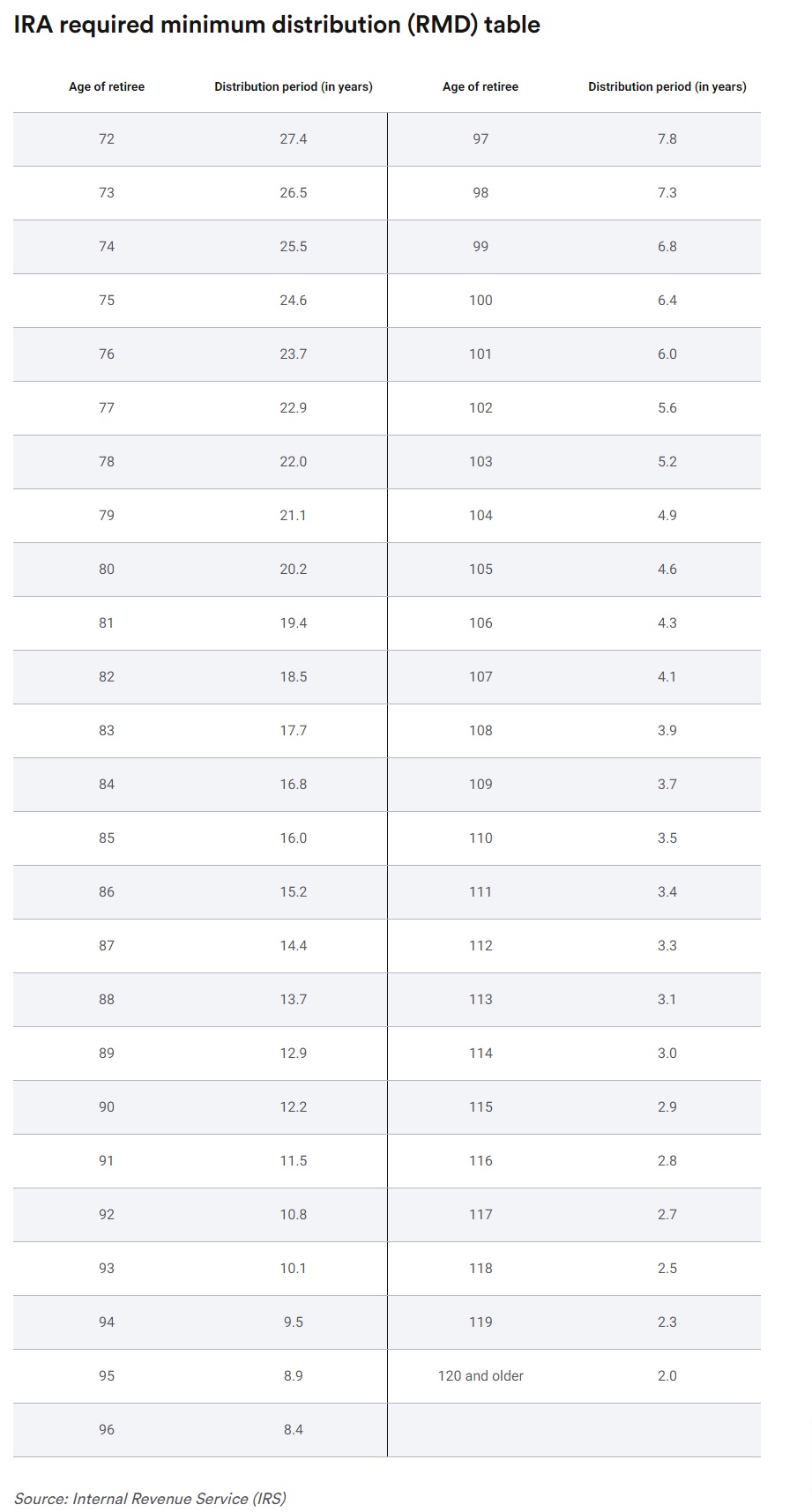

For the zero percent 401k tax strategy to work we first must figure out what your standard deduction will look like at RMD age (required minimum distribution age) which is currently age 72

Typically, the standard deduction increases at a 3% annual rate of inflation. The standard deduction as of 2023 for a married couple filing jointly with both the husband and wife the same age 65… is $28,700.

(See Standard Deduction Table Below Left)

We are planning for the zero percent tax bracket 20 years in advance so our couple in this example is 52 with a household income of $97,009 which puts them in the 22% tax bracket.

We’ll assume the current household income remains the same till retirement at age 70.

We’ll assume their combined social security income will be $57,339.26 at age 70.

The current trajectory of their 401k by age 72 is $1,227,568.

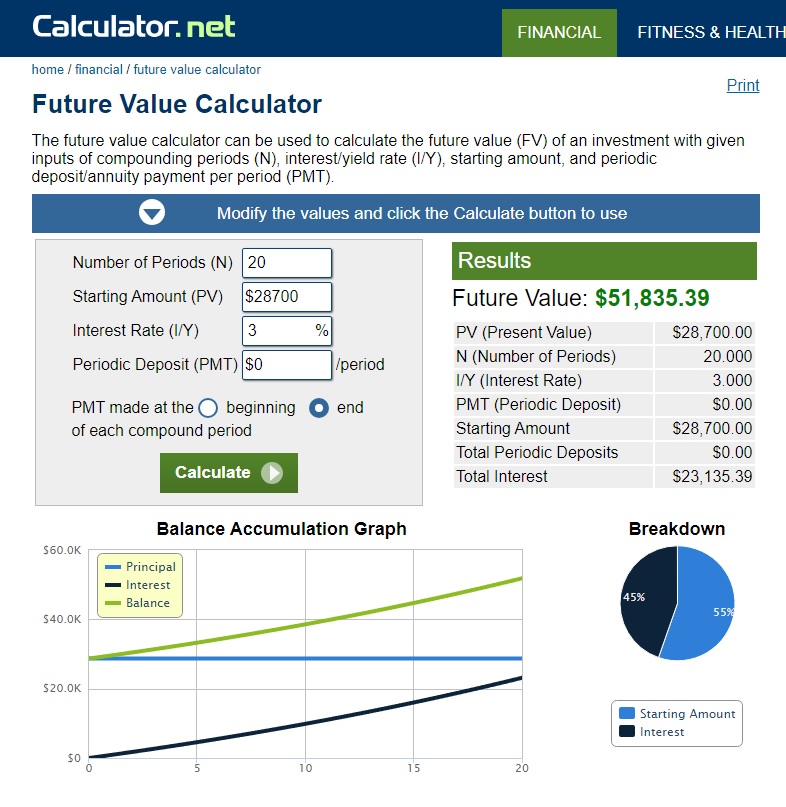

Using a 20-year future value calculation of $28,700, the new standard deduction 20 years later at the age of 72 is potentially $51,835.39.

The current RMD – Required Minimum Distribution divider at age 72 is 27.4. These figures are updated often.

The goal of this strategy is to remove money in excess of the standard deduction to include half of the social security income.

Adding the future RMD of $51,835.39 + $28,670 which is ½ of their social security income gives us a total of $80,505.39 of provisional income.

To figure out the taxable liability we will take $80,505.39 – $44,000 (which is the social security threshold) *85% equals $31,029.42.

We then add 50% of the next social security threshold of 12,000 which is $6,000 for a total of $37,029.42 subject to regular income taxes.

If we subtract the $37,029.42 subject to regular income taxes from the future RMD of $51,835.39 this leaves us with $14,805.97.

Our additional income from our 401k can’t exceed $14,805.97. This amount is below the RMD and below the social security income tax threshold requirements.

To figure out the total maximum balance for our 401k we simply multiply $14,802.97 by the RMD multiplier of 27.4 this gives us $405,683.57 as the total maximum remaining balance in our 401k account.

With the current 401k balance of $1,227,568 we need to reposition $821,884.43.

Basically, we subtract the maximum balance needed for our 401k account which is $405,683 and this gives us the $821,884.43.

We’ll first do a tax-free direct transfer of $300,000 into an asset-based long-term care annuity.

This will create two asset-based long-term care annuities at $150,000 each. If this money is needed for long-term care services in the future, there is a 2.5X multiplier which would increase each of the $150,000 LTC Annuities to $375,000 each. For a combined total of $750,000 this money can be accessed income tax-free if used for long term care services.

If you are age 70 or older, the annuity multiplier is 2.5X or in this example If you are age 40-60 the annuity multiplier is 4x.

So, we repositioned $300,000 from the tax-deferred 401k account for free into an asset that can increase to $750,000 for LTC purposes, income tax free.

There are no taxes due on this rollover when it’s a direct transfer. If you withdraw the money as a qualified withdrawal the IRS will give you 60 days to put the gross amount into an annuity or you’ll face a 20% tax.

The recommended method is to simply execute a direct rollover allowing the financial institutions to handle it.

The remaining $521,884.43 will be repositioned into a Roth IRA over 6 ½ years.

In this scenario we can reposition $81,141 each year for 6.5 years without our couple moving into the next tax bracket.

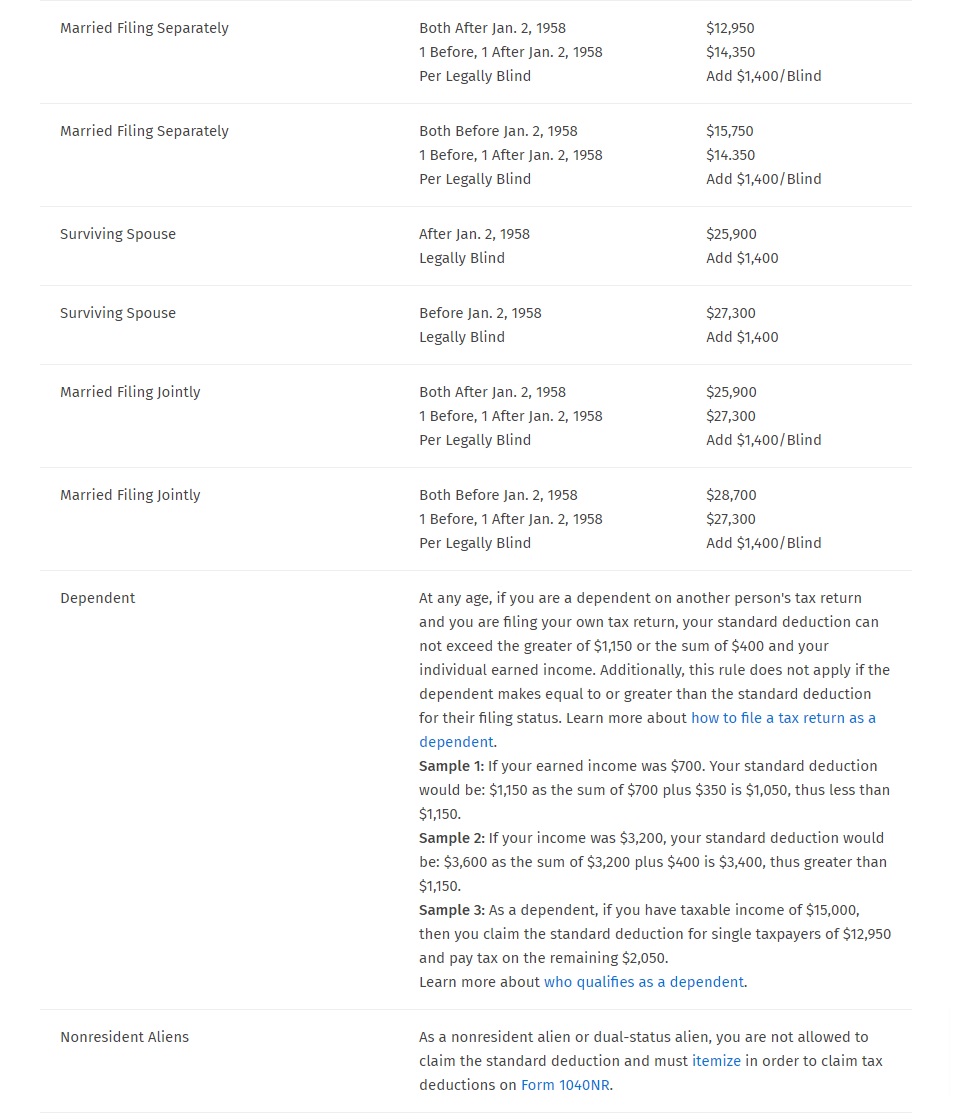

The current 22% tax bracket is between $83,550 – $178,150 married filing jointly.

Our couple has a combined income of $97,009 leaving room for the repositioning of $81,141 without increasing their tax bracket.

Many people make the mistake of converting the entire amount in one lump sum pushing them into the highest tax bracket and we certainly don’t want to do that.

The goal is to minimize the amount of taxes you pay by strategically repositioning the funds over a certain period of time while keeping you in your current tax bracket.

The 2022 tax brackets are listed below.

| Rate | Single Filers | For Married Filing Jointly | For Heads of Households |

| 10% | $0 to $10,275 | $0 to $20,550 | $0 to $14,650 |

| 12% | $10,275 to $41,775 | $20,550 to $83,550 | $14,650 to $55,900 |

| 22% | $41,775 to $89,075 | $83,550 to $178,150 | $55,900 to $89,050 |

| 24% | $89,075 to $170,050 | $178,150 to $340,100 | $89,050 to $170,050 |

| 32% | $170,050 to $215,950 | $340,100 to $431,900 | $170,050 to $215,950 |

| 35% | $215,950 to $539,900 | $431,900 to $647,850 | $215,950 to $539,900 |

| 37% | $539,900 or more | $647,850 or more | $539,900 or more |

In our example this couple will reposition money from a tax deferred account, paying taxes at today’s historically low tax environment to avoid paying higher taxes later.

With a 31.5 trillion national debt along with 76.5 trillion in unfunded future obligations which is social security and Medicare for a total debt of 108 trillion. Many economists and financial analysts are predicting a 40.5% average tax rate by the year 2039.

With our national debt it doesn’t make sense to delay paying taxes today to only pay higher taxes in the future when taxes are almost guaranteed to be much higher than today!

Repositing this money into a tax-free bucket like the “Roth IRA” will allow you to pay taxes at today’s historically low tax rate while avoiding all future taxes on your withdrawals.

We’ve created a tax-free social security income of $57,339.26 along with a 401k tax free distribution of $14,805.97 and a $21,000 tax free distribution from the Roth IRA for a total of $93,145.23 income tax free. Add in the $29,187 income tax free money from their cash value life insurance policy for a grand total of $122,342.23 income tax free.

$57,339.26 Income Tax Free Social Security

$14,805.97 Income Tax Free 401k Distributions

$21,000 Income Tax Free Roth IRA Distributions

$29,187 Income Tax Free Cash Value Life Ins Distributions

Grand Total

$122,342.23 Income Tax – Welcome To The Zero Percent Tax Bracket*

Let’s not forget about our Lump Sum Income Tax Free Buckets.

$200,000 Income Tax Free H.S.A. Lump Sum Cash Out @ age 65

$150,000 Income Tax Free HECM Access Account – Eliminating Mortgage Payments.

This leaves us with two long-term care funds up to $375,000 each for a total of $750,000 and can be accessed income tax free for long term care services.

Compare earning $97,000 during their working years in a 22% tax bracket with earning $122,342.23 income tax free along with a $350,000 lump sum bucket of tax-free money with a combined $750,000 of potential income tax free money if used for long term care services.

If you retire leaving your nest egg in these taxable and tax deferred accounts, there’s no real way to guarantee what your income will be as a result of not knowing how high taxes will rise!

In retirement you’ll have plenty of time to watch CNN, msn, fox etc. talk about the next debt ceiling fight or tax hike, wondering if these changes will cause you to run out of money.

A recent study showed current retirees are spending an average of 31% of their retirement income on taxes. For most retirees’ taxes will be your largest expense with health care at a close #2!

Let us eliminate this tax burden by helping you to achieve the zero percent tax bracket.

Is it possible for everyone to reach zero %? “NO” Many people will not be able to achieve zero percent, but you can still implement a plan to keep you in the lowest tax bracket possible. The more tax-free income you have in retirement the more stable you’ll be. If a zero percent strategy is not possible for your financial situation, using a partial tax-free income strategy along with a guaranteed income for life plan might be a better solution.

A note on the “Standard Deduction:”

In 2026 the standard deduction is set to return to the 2017 levels along with our current historically low tax rates, however evidence suggests the current tax rates will be extended for at least 8 years. This strategy of paying zero taxes on your 401k / IRA depends on what the standard deduction is, in the future. If the standard deduction in the future isn’t friendly with this strategy, you would simply follow the other steps in the process by converting more money via a ROTH IRA Conversion. You will save a ton of money if these conversions are done prior to 2034. 2034 and beyond will significantly increase the importance of tax-free growth and income. You can certainly execute this strategy when the tax rate goes up but why not get a discount on your conversions by taking advantage of today’s historically low tax rates.

Part II

Delay Taxes to A Future Date With An Unknown Future Tax Hike Or Pay Taxes At Todays Rate?

I’m often asked if 401k is worth the trouble and my response is this:

If you are receiving an employer match it’s a good idea to take advantage of this “FREE MONEY” every dollar your employer matches is basically a 100% return on your money its free money. I would not suggest contributing more than your employer match we can allocate this money into a different tax-free bucket, just make sure you take notice of the vesting schedule.

A typical vesting schedule might look like this:

You could have a graded vesting period of 20% after 2 years of service, 40% after 3 years of service, 60% after 4 years of service, 80% after 5 years of service and 100% after 6 years of service. The vesting period is very important especially if you find yourself having to cash out your 401k. Let’s say you cash out your 401k prior to age 59 ½ and you’re not 100% vested. Not only will you pay current income tax you’ll also pay a 10% early withdrawal penalty along with losing any unvested portion of the account value, this could become very costly.

Now, let’s compare tax deferred vs tax free!

Tax deferred growth in a 401k / IRA versus tax free growth in a Roth IRA or other tax-free bucket, which is better?

Let’s assume you contribute $21,164 pretax into a tax deferred 401k or IRA with no employer match. Let’s also assume a 10% rate of return for 30 years with no other contributions for easy math. This scenario also assumes a 25% tax bracket before and after retirement. We’re also not accounting for management and fund fees.

After 30 years of 10% growth the account value would equal $419,838.72 the after-tax account value would be $314,879.04 assuming the same 25% tax bracket.

With the second example we’ll invest the same amount but only this time will pay with after-tax dollars. Assuming the same 25% tax bracket our after-tax contribution into a tax-free bucket will be $15,873 with a 10% rate of return for 30 years assuming the same 25% tax bracket before and after retirement.

$21,164 x 25% = $5,291.

$21,164 – $5,291 = $15,873

$15,873 with the same 10% rate of return for 30 years = $314,879.04 income tax free which is the same amount you’ll receive after paying 25% taxes with the pre-tax, tax deferred 401k account.

The tax deferred 401k / IRA has no advantage overpaying taxes at today’s rate and investing in a tax-free tool assuming the same tax bracket before and during retirement.

The 401k / IRA will require an RMD by age 72, The IRS wants their money so you will face a required minimum distribution or face a 50% penalty while the tax-free bucket doesn’t have an RMD, the tax-free bucket doesn’t have a penalty.

If you die with money in the 401k / IRA, the balance will transfer to your beneficiaries at their current income tax bracket. The money left in the Roth IRA will be passed on to your beneficiaries’ income tax free. If the tax-free bucket was also a cash value life insurance your beneficiaries will receive the remainder of the policy income tax free.

The benefits of tax-free certainly outweigh the benefits of tax deferred when all things are equal however in the real world all things are not equal. The national debt is 31.5 trillion with a total debt of $108 trillion in unfunded obligations.

In 1978 when 401ks started the tax environment was totally different than 2023 and the national debt in 1978 was $772 Billion. The idea was delaying taxes today because taxes are going to be lower in the future when you retire it was also assumed the national debt would be lower not higher. Obviously, that’s not how it’s working out with a national debt of 31.5 trillion 40.5 times higher than what it was in 1978 when 401ks first started.

If we go back to our scenario above and our future tax bracket is 15% higher the numbers become depressing for the tax deferred buckets. Instead of $314,879.04 after tax we now only have $251,903.23 after tax.

When looking at a full portfolio of $2,000,000 in a tax deferred versus tax free, the numbers are even more scary.

With a 15% tax bracket increase the $2,000,000 would be $1,200,000 while the tax-free bucket account would be $1,500,000 this a huge $300,000 difference in real money received, this is a $300,000 mistake.

Planning for the “Great Tax Risk” is just as important as planning for the “Great Longevity Risk.”

If you have income in retirement coming from a lifetime guaranteed income sources such as Social Security, a Federal or State Pension plan or a guaranteed lifetime income Fixed Index Annuity, I will suggest to you, this income is not really guaranteed because your future tax bracket isn’t guaranteed.

If your guaranteed income is $50,000 in a 22% tax bracket and 5 years into retirement the government raises the taxes by just 8% your after-tax income will drop from $39,000 down to $35,000!

As a result of the current national debt along with more people potentially receiving social security and Medicare retirement benefits than workers paying into the system there’s really no other way to pay for the debt and unfunded obligations without drastically raising taxes.

This is one reason why the Zero Percent Tax Bracket Strategy is front and center.

In the next segments I’ll go over the other tax-free buckets I mentioned:

- Tax Free 401k Distributions

- Tax Free HAS Distributions

- Tax Free HECM Distributions

- Tax Free Asset-Based LTC Annuity Distributions

- Tax Free Roth IRAs / Roth 401ks Distributions

- Tax Free Distributions From A Roth Conversion

- Tax Free Cash Value Life Insurance Distributions

- Tax Free Social Security Income Distributions

- Tax Free Capital Gains Distributions

- Tax Free Capital Gains-Sale Of Home

All these buckets can add up to The Zero Percent Tax Bracket!

Pay zero taxes on your H.S.A. Distributions During Retirement.

When I mention an HSA can be used for tax free income in retirement, I always get the “Question Mark Look.” An HSA tax free income plan is an extremely underused strategy that should be a part of any comprehensive retirement plan.

People know what an HSA is but don’t know what an HSA can do!

I remember in 2003 when George Bush signed into law HSAs in December 2003, I first learned about them in a BCBS sponsored workshop. The idea of HSAs actually came from the failed program of MSAs or Medical Savings Accounts which was a part of the 1996 Health Insurance Portability and Accountability Act.

HSAs provide “Triple-Tax Advantage Savings” You can contribute pre-tax money so the money goes in with a tax deduction, the money grows tax-free, and you can spend the money tax-free!

How many investments tools do you have access to with triple tax advantages?

In keeping with the traditional use of an HSA most people are aware you can use HSA monies for medical expenses. Most people are aware HSAs are a part of high deductible health care plans.

A typical HSA usage scenario is this:

You contribute $2,500 pre-tax to an HSA and by the end of the year you’re spending HSA monies to reimburse yourself for small copays and medications. I speak with many employees who try to guesstimate medical expenses for the upcoming year so as not to contribute a dollar over the guesstimated expenses.

This type of strategy is a very limited 360 view of how you might manage your HSA. Human resources personnel are not financial advisors and lack the training necessary to deep dive into the “Triple-Tax Advantage Savings of an HSA. A study conducted by the EBRI Employee Benefits Research Institute found only ½ of people employed selected an HSA with a high deductible health insurance plan. The overwhelming majority of these HSA accounts are not invested. People don’t know you can invest the funds inside of the HSA, just like a regular IRA. The study found that after 15 years of having an open HSA only 20% of these accounts are invested.

An HSA can be used for future tax-free income in retirement if structured properly. As of 2022, If you’re single, your contribution limit is $3,650 pretax but if you are 55 and over you can contribute an extra $1,000 pretax, that’s $4,650 invested pretax along with investing up to the max if you had access to a Roth 401k with your employment or investing up to your employers match with a regular 401k. For families you can contribute up to $7,300 into an HSA and $8,300 if you’re older than 55.

When you retire at age 65 you can withdraw the money from your HSA, just like you would your 401k or IRA, and you’ll pay taxes on the withdrawal just like these other tax deferred accounts however, A major advantage with an HSA versus an IRA or 401k is this: HSA distributions do not count as provisional income and therefore will not trigger taxes on your Social Security income.

The income from your 401k /IRA does count as provisional income and can trigger the paying of taxes on your social security income.

This is a huge plus for the HSA, it doesn’t count as provisional income therefore it will not trigger taxes on your social security income, and it will not trigger an IRMA surcharge payment. The IRMA surcharge is what you’ll pay in extra Medicare premiums if your provisional income is above the Medicare threshold.

You will pay taxes on the HSA distributions during retirement if these funds are needed for non-medical expenses as explained above.

If in retirement you withdraw HSA monies for health-related expenses the withdrawals in retirement will be income tax free.

As explained above, most HSA contributors claim the reimbursement in the year, they incur medical expense.

What if instead of seeking reimbursement in today’s historically low tax environment, you delayed all of your reimbursements till retirement. What if along with your typical reimbursements such as copays, prescription drugs and deductibles, you could also get reimbursed for items such as:

Athletic Tape, Anti-Snore Guards, At Home COVID-19 Test, Disposable Face Masks, Anti-Bacterial Hand Sanitizer, Motorized Wheelchair, Ibuprofen, Aspirin, Condoms, Chiropractor Treatment, Fish Oil, Supplements LMN, Fitness Programs LMN, Fitness Tracker LMN, Sales Tax-Taxes on Medical Services and Products, Tylenol. You can even geek reimbursed for Long-term care insurance and medical modifications to your home, such as installing an elevator!

The list of items you can seek reimbursement on is “HUGE.” See below for a full list of reimbursements you can seek.

Many of these items’ people pick up at the local convenient stores, such as Ibuprofen, Aspirin, Tylenol and Condoms without realizing they can reimburse themselves tax free with sales tax included.

From age 30 to 65 you can very easily spend over $200,000 on these items. You might be thinking $200,000 is a lot of money to spend on these items but I challenge you to add up what you spend daily on these common items along with the typical large items in fact, if you have any medical conditions at all, you could easily spend over $200,000 from age 30 to 65. Just look at the list below with all the items you can seek reimbursement for, it will absolutely shock you!

Here’s the strategy!

Start tracking and saving your receipts on over 3,000 plus items you spend money on but didn’t realize you could seek reimbursement for.

Don’t claim these reimbursements today, delay until age 65 or full retirement age.

The secret sauce to this strategy is this: The IRS gives you an “Unlimited Amount of Time To Claim A Reimbursement” even if it’s 30 or 40 years later as long as you keep your documentation in order.

If you invest the monies inside of your HSA, you’ll receive a tax deduction on the front end while allowing the money to grow tax deferred and once you reach age 65 you can claim a reimbursement of $200,000 or more income tax free or whatever your reimbursement totals equal to for the health medical expenses you incurred during your working years.

You just have to start tracking your health-related expenses, use google docs, drop box an excel spreadsheet, make sure you routinely back this information up.

One final note, you don’t want to over contribute to an HSA, my office can you determine the optimal amount of money you should be contributing to your HSA. Typically, we’ll plan for an amount of health care related expenses you might incur over 30 years or until age 65 while also factoring in an average growth rate of return. The ideal scenario is to receive an income tax free lump sum reimbursement of at least $250,000 at age 65 while also maintaining a balance of tax-free money you can use for future medical expenses during retirement. After the first lump sum it’s no longer necessary to delay reimbursement of medical expenses during retirement you should take these reimbursements as the occur. With taxes representing your highest expense during retirement, for many people medical related expenses could potentially be your 2nd largest expense during retirement so maintaining a tax-free pool of money for these future expenses might be a good idea.

Let’s say you are 40 years old planning on retiring at age 65 and you decide to only contribute $3,000 per year but according to current IRS guidelines in 2023 you can contribute $3,850 as a single person, if over 55 you can contribute an additional $1,000, and for families you can contribute $7,750 plus an additional $1,000 if over 55.

In this example we’ll assume a contribution of just $3,000 each year for 25 years with an 8% growth rate. In this example the account value would be $241,176.69 at age 65. If you accumulated $200,000 of health & medical related expenses during your working years, at age 65 in this example you could access $200,000 as a lump sum income tax free cash out reimbursement leaving $41,146.69 for future tax-free health care reimbursements.

Two scenarios:

You can grow money inside of your HSA you can access during retirement just like any other tax deferred accounts such as 401k / IRAs and you’ll pay taxes on this money.

Or you can track all health-related spending during your working years and access the same money as a lump sum reimbursement during retirement, income tax free!

This strategy plays an important role in pursuit of the Zero Percent Retirement Tax Bracket.

Which path will you choose to follow?

View the list of reimbursement items below!

https://www.healthequity.com/hsa-qme

A

AA Meetings

Acetaminophen

Acid Controller

Acne Medicine

Acupressure LMN

Acupressure Mat

Acupressure Wrist Band

Acupuncture

Adaptive Equipment

Air Conditioner LMN

Air Filter LMN

Air Purifier LMN

Airfare Related to Medical Treatment

Alcoholism/Substance Abuse Treatment

Allergy Medicines

Allergy Products and Treatment LMN

Allergy Testing

Aloe Vera LMN

Alopecia Treatment LMN

Alternative Healers

Alternative Treatments

Ambulance and Emergency Room

Analgesics (OTC)

Anesthesia

Ankle Brace

Antacids

Anti-Bacterial Hand Sanitizer (60%+ Alcohol)

Anti-Diarrheal

Anti-Embolism Socks, Stockings LMN

Anti-Fungal Treatments

Anti-Gas Medicine

Anti-Inflammatories

Anti-Itch Cream or Lotion

Anti-Parasitic Rx

Anti-Snore Guards

Antibiotic Ointments

Antibiotics Rx

Antidepressants Rx

Antihistamines

Antipyretics (fever reducers)

Antiseptics

Arch Support

Arm Sling

Arthritis Gloves

Arthritis Medicines

Artificial Insemination

Artificial Limbs

Artificial Reproduction

Aspirin

Assisted Living LMN

Asthma Medicine Rx

Asthma Oxygen Flow Monitor

At Home COVID-19 Test

At-Home Drug Test LMN

Athletic Bandages & Braces

Athletic Mouth Guard

Athletic Tape

Athletic Treatments

Automated External Defibrillator (AED)

Automobile Modifications LMN

B

Baby Breathing Monitor

Baby Rash Ointment and Cream

Baby Sunscreen

Back Brace

Band-Aids

Bandage Clips

Bandages

Bandages, elastic

Bariatric Surgery

Batteries for Medical Devices

Bed Pan

Bed Wetting Aids

Behavioral modification programs

Benadryl

Bifocals

Bio Freeze

Birth Control (Rx) Rx

Birth Control (OTC)

Birthing Classes LMN

Birthing Coach LMN

Blood Donation

Blood Pressure Monitor or Unit

Blood Storage LMN

Blood-sugar test kits and test strips

Body Restoration Technique LMN

Body Scan

Bonding of the teeth LMN

Books, health-related LMN

Bracanalysis Testing

Braces

Braille Books

Breast Implant Removal LMN

Breast Milk Storage Bottles or Bags

Breast MRI

Breast Pump

Breast Pump Bustier

Breast Reconstruction Surgery

Breast Reduction LMN

Breastfeeding Classes

Breathalyzer

Bridges

Bus Fare for Medical Treatment or Services

Butterfly Bandages

C

Calamine Lotion

Calcium Scoring

Calcium Supplements LMN

Callus Remover (Medicated)

Cancer Screenings

Cane

Canker Sore Treatment

Capital Expenditures LMN

Car Changes for Health Reasons LMN

Car Modifications for Health Reasons LMN

Car Rental (related to medical care)

Cardiac Calcium Scoring

Cardiac Treatment

Carpal Tunnel Support

Cast Cover

Cataract Surgery

Catheter

Cayenne Pepper LMN

Cervical Pillow LMN

Chair, Specialized or Ergonomic LMN

Chelation Therapy LMN

Chest Rub

Child Medical Care

Childbirth

Childbirth Classes

Children’s Sunscreen

Chinese Herbal Practitioners LMN

Chiropodist Treatment

Chiropractor Treatment

Cholesterol Test Kit

Chondroitin

Christian Science Practitioner

Circumcision

Classes, Health-Related LMN

Co-Insurance

Co-Payments

COBRA Premiums

Cocoa Butter LMN

Coconut Oil LMN

Cold Compress, Pain Relief

Cold Medicine

Cold Packs

Cold Sore Treatment

Colic Relief

Collagen Injections LMN

Colon Therapy, Colon Hydrotherapy, Colonics LMN

Companion Animals LMN

Compression Hosiery

Compression Sleeves

Compression Socks

Concierge Medicine

Condoms

Constipation Medication

Contact Cleaning Solution

Contact Lens Case

Contact Lenses Rx

Contact Solution

Contraceptives (Rx) Rx

Contraceptives (OTC)

Convalescent Home

Cooling Gel Sheets for Fever Reduction

Cord Blood Storage LMN

Corn Remover

Corneal Keratotomy

Corneal Ring Segments

Cough Drops

Cough Suppressant

Cough Syrup

Counseling

COVID-19 Test

CPAP Cleaning Products

CPAP Hose Holder

CPAP Machine

CPAP Mask and Headgear

CPAP Pillow

Cranberry Pills LMN

Cranial Sacral Therapy LMN

Crowns (Dental) LMN

Crutches

Crystalens

CT Scan

D

Daith Piercing LMN

Dandruff Shampoo LMN

Decongestant

Deductible Cost

Defibrillator

Dehydration Treatment

Dental Care

Dental Cleaning

Dental Dam

Dental Implants (Medical)

Dental Maintenance Organization (DMO)

Dental Procedures

Dental Reconstruction

Dental Sealants

Dental Services and Procedures

Dental Veneers

Denture Adhesive

Denture Cleaning Supplies

Denture Stain Cleaner

Denturist

Dermatology Treatment LMN

Detoxification

DEXA Scan

Diabetic Bracelet

Diabetic Monitors

Diabetic Socks

Diabetic Supplies

Diabetic Test Kit

Diabetic Test Strips

Diagnostic Products

Diagnostic Services

Diaper Rash Cream & Ointment

Diarrhea Medicine

Diathermy

Dietitian LMN

Digestive Aids

Digital Thermometer

Dilator

Disability Premiums

Disabled Dependent Care Expenses, Medical

Disabled Person, expenses for

Disposable Bra Pads for Nursing

Disposable Face Mask to Prevent COVID-19

Disposable Underwear

Diuretics LMN

DNA Storage LMN

Doctor Fees

Donor Fees

Doula LMN

Drug Addiction Treatment & Counseling

Drug Overdose Treatment

Drug Testing Kits for Home Use

Drugs and Medicines

Durable Medical Equipment

Dyslexia Treatment

E

Ear Drops and Wax Removal

Ear Plugs LMN

Ear Syringe

Ear Thermometer

Ear Wax Removal

Eczema Treatment

Educational Classes for Medical Condition LMN

Egg and Embryo Storage Fees LMN

Egg Donor Fees LMN

Egg Recipient Fees LMN

Elastics for Athletes

Electrolyte Replacements (Non-Baby)

Electrolyte Replacements (Baby)

Electrotherapy Pain Relief Device

Elevated Toilet Seats

Elevator in Home LMN

Enema

Epinephrine Rx

Epsom Salt

Erectile Dysfunction Treatment Rx

Ergonomic Items LMN

Essential Oils (for medical care) LMN

Exercise Equipment LMN

Expectorants

Experimental Drugs Rx

Experimental Medical Services

Eye Drops (OTC)

Eye Equipment Rx

Eye Exams

Eye Mask for Pain Relief

Eye Pressure Monitor

Eye Related Equipment Rx

Eye Surgery

Eye Treatment Medications Rx

Eyeglass Accessories

Eyeglasses Rx

Eyewear Repair Kit

F

Face Cream with Medication Rx

Feminine Hygiene Products

Feminine Pain Relief

Fenugreek Supplement LMN

Fertility Monitor

Fertility Treatment

Fever Reducing Medications

Fiber Laxatives

First Aid Adhesive

First Aid Cream

First Aid Drugs and Medicines

First Aid Kit

First Aid Supplies

Fish Oil Supplements LMN

Fitness Programs LMN

Fitness Tracker LMN

Flu Shot

Fluoridation Services

Fluoride Rinse LMN

Fluoride Treatment

Foot Care

Forehead Thermometer

Foreign Medical Care

Fuel, Gasoline for Medical Care

G

Gait Belt

Gambling Addiction Treatment

Gas Relievers

Gastric Bypass Surgery Including Excess Skin Removal

Gastrointestinal Medication

Gauze

Gel Breast Pads

Genetic Testing

Glasses

Glucosamine

Glucose Gel

Glucose Monitor

Glucose Monitoring Supplies

Glucose Tablets

Grab Bars for Bathroom

Guards for Teeth Grinding

Guide Dog

Gynecologist

H

Half Way House LMN

Hand Lotion Containing a Medicine LMN

Hand Sanitizer to Prevent COVID-19 (60%+ alcohol)

Hand Sanitizing Wipes to Prevent COVID-19

Handicap, Disability License Plates

Headache Medications

Health Institute Fees LMN

Health Screenings

Hearing Aid Batteries

Hearing Aids

Heart Rate Monitor

Heart Scan

Heated Neck Rest

Heating Pads

Hemorrhoid Treatment

Herbal Medication LMN

Herbs LMN

HMO (Health Maintenance Organization)

Holistic Healers

Home Defibrillator

Home Diagnostic Kits, Tests, Devices

Home Health Care

Home Improvements LMN

Homeopathic Medicine

Hormone Replacement Therapy Rx

Hospital Care

Hospital Insurance Premiums

Hospital Services and Fees

Hot and Cold Compress

Hot Packs

Human Growth Hormone (HGH) Rx

Human Guide

Humidifier LMN

Hydrocortisone

Hydrogen Peroxide LMN

Hydrotherapy LMN

Hyperbaric Oxygen Therapy LMN

Hyperbaric Treatments LMN

Hypnosis LMN

Hysterectomy

I

Ibuprofen

Ileostomy Supplies Rx

Immunizations

Immunotherapy

Impotence Medicines and Treatments Rx

In Vitro Fertilization (IVF)

Inclinator LMN

Incontinence Supplies

Indigestion Treatment

Infant Formula LMN

Infertility Treatment

Injection Snoreplasty

Inpatient hospitalization services

Insect Bite Creams and Ointments

Insoles

Instant Ear Thermometer

Insulin

Insulin Supplies

Insurance Premiums

Inversion Table

Investigational Surgery

Invisalign Orthodontics

Iron Supplements LMN

Isopropyl Alcohol

IV Equipment and Stands

J

Joint pain relievers

Joint Supplement

K

Kenalog Injections

Ketone Test Strips

Kids Training Pants LMN

Kinesiology

Kinesiology Tape

Knee Wraps and Support

L

Lab Fees

Laboratory Fees

Lactation Aids

Lactation Consultant

Lamaze Classes

Lancet

Language Training LMN

Lanolin

Lap Band Surgery

Laser Eye Surgery

Lasik

Laxatives

Lead-Based Paint Removal LMN

Learning Disability Treatment LMN

Legal Abortion

Legal Fees LMN

Lessons LMN

Lice Treatment

Life Alert Emergency Medical Alert System

Light Therapy

Lip Balm (SPF 15+)

Liquid Adhesive for small cuts

Listening Therapy

Lodging for Medical Care

Lodging of a Companion

Long Term Care Premiums

Lubricants LMN

Lumbar Support

M

Magnetic Therapy LMN

Mammogram

Massage Therapy LMN

Mastectomy-related Bras

Maternity Charges

Maternity Support Belt

Medical Alert Bracelet

Medical Care Outside the U.S.

Medical conference admission, transportation, meals, etc LMN

Medical, Dental or Vision Office Visits

Medical Equipment

Medical information Plan Fees

Medical Monitor

Medical Records Charge

Medical Testing Devices

Medicare Premiums

Medicated Body or Face Wash

Medicated Hand Cream

Medicated Lip Treatments

Medicated Shampoo LMN

Medicine Droppers

Medicines and Drugs that are Over-the-Counter (OTC)

Medicines, Prescription Rx

Mediscope

Melatonin LMN

Menopause Treatment and Medical Services Rx

Menstrual Pain Relievers

Mentally Handicapped, Special Home LMN

Midwife Treatment

Migraine Cooling Headache Pads

Migraine Relief (Medicated)

Mileage for Travel for Medical Care

Milk of Magnesia

Mineral Supplements LMN

Mobility Scooter

Mold Removal LMN

Moleskin

Morning After Pill

Motion Sickness Medicine

Motion Sickness Wristbands

Motorized Wheelchair

MRI

Multivitamins LMN

Muscle pain relievers

N

Nasal Aspirator

Nasal Spray

Nasal Strips

Natural Lens Replacement

Naturopathic Healers LMN

Nausea Medicine

Nebulizer

Needle Container

Neti Pots

Neurologist

Newborn Care

Newborn Nursing Care

Nicotine Gum

Nicotine Patches

Night Mouth Guards

Non-Prescription Drugs and Medicines

Norplant Insertion or Removal

Nose / Nasal Strips (for congestion relief)

Nursing Bra

Nursing Home

Nursing Services

Nursing Supplies

Nutritional Supplements LMN

Nutritionist LMN

O

OB/GYN

Obstetrical Care

Occlusal Guards

Occupational Therapy LMN

Omega-3 Supplements LMN

Oncologist

Online or Telephone Consultation, Medical Practitioner’s Fee

Operations

Ophthalmologist

Optometrist

Oral Glucose Gel

Oral Remedies and Treatments

Organ Donation

Organ Transplant

Ortho Keratotomy or Orthokeratology

Orthodontia

Orthodontia Wax

Orthokeratology

Orthopedic and Surgical Supports

Orthopedic Neck Support

Orthopedic shoe inserts

Orthopedic Shoes LMN

Orthotics

OSHA Handling Fees for Biohazard Waste Disposal

Osteopath Fees

Ostomy, Colostomy Supplies

Out-of-network provider

Over-The-Counter Items

Over-the-Counter Medicine

Ovulation Monitor

Oxygen Equipment

P

Pads

Pain Relief Eye Mask

Pain Relievers

Parking Fees for Medical Care or Treatment

Particulate Respirator Mask to Prevent COVID-19

Patterning Exercises

Peak Flow Meter

Pedometer LMN

Penile Implants LMN

Peroxide

Personal Protective Equipment (PPE) to Prevent COVID-19

Personal Trainer LMN

PET Scan

Petroleum Jelly LMN

Phototherapy

Physical Exams

Physical Therapy

Pill Boxes and Pill Clocks

Pill Cutters, Pill Boxes, Pill Sorters and Pill Organizers

Pillow for Lumbar Support LMN

Pre-existing Condition

Pregnancy Aids

Pregnancy and Fertility Kits

Pregnancy Tests

Premiums

Prenatal Gummy Vitamins

Prenatal Ultrasound

Prenatal Vitamins

Prescription Drugs and Medicines Rx

Prescription drugs and medicines obtained from other countries Rx

Preventive Care

Preventive Care Screenings

Private hospital room

Probiotics LMN

Progesterone and Testosterone Hormones Rx

Prosthesis

Protective Face Mask to Prevent COVID-19

Proton Pump Inhibitors Rx

Psychiatric care

Psychoanalysis

Psychologist

Pulse Oximeter

R

Radial Keratotomy

Radon Mitigation LMN

Reading Glasses

Reasonable and Customary (R&C)

Reflexology LMN

Rehabilitation Center

Rehydration solution

Rental Cars

Retainer

Rhinoplasty LMN

Rubbing Alcohol

Rubdowns LMN

S

Sales Tax

Saline Nasal Spray

Sanitary Pads

Scale for Food or Weight LMN

Scar Treatment LMN

Schools and education, residential LMN

Schools and education, special LMN

Scooter, electric LMN

Screening Tests

Sea-band for Motion Sickness

Sedatives Rx

Seeing-eye Dog LMN

Service Animal LMN

Sexual Counseling LMN

Sexual Dysfunction LMN

Sharps Container

Shipping Fees

Sinus Medicine

Sinus Rinse

Sitz Bath

Skin Tag Removal LMN

Sleep Aids (OTC)

Sleep Deprivation Treatment

Smoking Cessation Products

Smoking Cessation Programs

Somnoplasty

Special Foods LMN

Special School LMN

Speech Therapy

Sperm Storage Fees (Short Term)

Spermicidals

Spinal Decompression

Splints

Stair Lift

Steam Inhaler

Steam Packs

Stem Cell Storage LMN

Sterilization

Stethoscope

Stool Softeners

Stop Smoking Program

Sublingual Immunotherapy

Substance Abuse

Subway Fare for Medical Treatment

Sunburn Creams and Ointments

Sunglasses, prescription

Sunscreen

Sunscreen for Kids

Sunscreen with Insect Repellant

Supplements LMN

Supplies to treat a medical condition

Support Braces

Support Hose LMN

Suppositories

Surgery

Swimming Pool LMN

Syringes

T

Tampons

Taxes on Medical Services and Products

Taxi Fare

Teeth Grinding Prevention

Teething Pain Reliever

Telehealth

Telephone Consultation (Healthcare Professional Fee)

Telephone for Hearing Impaired Individual

TENS Machine

Testosterone

Therapy Eye Mask

Therapy, mental health LMN

Thermography

Thermometer

Throat Lozenges

Toenail Fungus Treatment

Tolls for Medical Care or Treatment

Tooth Extraction

Toothache pain relievers

Topical Analgesics (Muscles and Arthritis)

Topical Skin Treatment

Topical Steroids

Tourniquet

Transcutaneous Electrical Nerve Stimulation Device

Transgender Counseling or Surgery

Transitions Lenses

Transplant

Transportation expenses for person to receive medical care

Travel or Transportation for Medical Care

Travel Sized Sunscreen

Treadmill LMN

Tricare Fees

Tubal ligation

Tuition for Special Needs Schooling LMN

Tuition, medical charges included

Turmeric (for medical use) LMN

Tutoring LMN

Tylenol

U

UCR, Charges Above

Ultrasound

Ultrasound, Prenatal

Umbilical cord blood storage LMN

Upset Stomach Relief

Urinalysis

Urological Products

Used Needle Container

Usual and customary charges, excess

UVR treatments

V

Vaccinations

Vaccine

Vapor Rub

Vaporizer

Varicose Vein Surgery

Vasectomy and Vasectomy Reversal

Viagra

Vision Correction

Visual Evoked Potential (VEP) Test

Vitamins LMN

W

Walker

Walking Aids

Water Fluoridation LMN

Water Resistant Sunscreen

Waterpik LMN

Wax for Braces

Weight Loss Counseling LMN

Weight Loss Programs LMN

Weight Loss Surgery

Wellness Scan

Wheelchair and Repairs

Wig LMN

Wipes for Glasses

Wisdom Tooth Extraction

Wound Care

Wound Seal Powder

Wrist Support

X

X Rays

X-Ray Fees

Y

Yeast Infection Medications

Yoga LMN

Also see:

https://hsastore.com/hsa-eligibility-list/l

Pay zero taxes on your Annuity Distributions During Retirement.

When you purchase an asset based long term care deferred annuity, these funds can be accessed income tax-free if needed for qualifying long term care services.

70% of retirees aged 65 and older will need some type of long-term care services in their lifetime.

If you need care in a nursing home or assisted living facility, home health care, Hospice care, adult day care, Bed reservation, Respite care, you can pull monies from this special deferred annuity income tax free.

If you are unable to perform 2 out of the 6 daily living activities, then you’ll qualify for long term care services.

The strategy is to reposition monies into an asset based long term care deferred annuity and with proper planning access these funds at a future date, income tax free when accessed for qualifying long term care services.

A few of my favorite asset based long term care annuities will more than double the purchase value when needed for long term care services and if you are between the ages of 40-60 it can 4X the purchase value.

For example, if you are age 70 or older when you experience a qualifying long-term care need, if your purchased annuity value is $250,000 for long-term care services this amount would 2.5X to 625,000. If you are between 40-60 when you need these services, the value would grow 4X to $1,000,000.

If you die peacefully in your sleep without ever accessing these funds for LTC, the annuity values will transfer to your beneficiaries.

With a traditional long term care plan if you die peacefully in your sleep never needing to use the policy, your beneficiaries get nothing.

With a traditional long-term care plan the premiums can go up every 5 years by 20% or more with each premium increase. Often times retires who start off will all the bells and whistles on their ltc policy, end up losing the benefits after paying high premiums to include these bells and whistles on the plan, with the very first premium rate increase, the bells and whistles benefits are the first to go! (This ends up being a total waste of your hard-earned retirement income)

Last but not least, with a traditional LTC plan you have to medically qualify. Many seniors wait until age 60 before purchasing a long-term care policy and as a result many seniors aged 60 can’t qualify for an affordable plan or they are flat out declined for coverage. I hear famous TV & Radio Gurus advising their listeners not to purchase a long-term care hybrid plan (which is cheaper by the way) and not to purchase a long-term care policy until age 60. If you follow this advice there’s a 64% chance you will not qualify for the plan when you turn 60 and if you do qualify the premiums might be cost prohibitive.

There’s no medical questions with the asset based LTC Annuity, there’s not premium increases, and if you never use the plan the funds will transfer to your heirs as an inheritance!

This is just one more tool potentially providing you with tax free money during retirement.

Pay zero taxes on your Cash Value Life Insurance Distributions During Retirement.

No contribution limits no age limits on withdrawals no RMDs

A few awesome benefits of an index universal life insurance product is this: there are no contribution limits so you can contribute as much money as you want up to the original design of the policy and it will always be taxed advantaged. No age limits you just have to qualify medically and there are no distribution limits, remove as little or as much as you like “No RMDs!”

These attributes make it very attractive for high Network earners, individuals who’ve already maxed out other sources.

Another attractive feature of an indexed universal life insurance policy is the point-to-point annual reset.

The annual point-to-point in essence allows you to lock in the current year’s gain while preventing your account value from going backwards regardless of how the market performs.

If you’ve ever been on a roller coaster, then you will understand how the annual point to point works in a life insurance product.

As you are ascending the roller coaster tracks there’s a very loud clicking noise, this mechanical clicking noise is the coaster locking you into place preventing you from going backwards. If there was ever a malfunction with the coaster you would be automatically locked into place with the very last, click…. you can only go forward.

The annual point to point with an index universal life insurance policy works the same way, each year your account has a gain, there’s a clicking noise automatically locking your gains into place preventing your account values from going backwards.

This autopilot functionality Works 24 hours a day even while you’re sleeping.

An index universal life insurance policy doesn’t directly invest in the market. The interest is credited to the account by the insurance company linked to the gains of an index without directly investing in the market…. This allows you to enjoy the upward movement of the account without ever have having to worry about a decrease.

When the market is doing good you will see an increase in your account. If the market drops by 44% like it did in 2002 and again in 2008 or like it dropped 33% between 21 and 2022….. You simply will not be credited with any gains; your credit will be zero.

You will not lose 44% or 33% or even 1%, you will lose nothing if the market goes south, doesn’t matter if it’s down for 3 years or more you will not lose any money due to market decline. When the market rebounds you’ll again start to receive a portion of the gains.

The annual point to point is your best friend when the market is down, it’s a security blanket against financial loss.

A properly structured IUL will not outperform a growth stock portfolio, however it can outperform the bond portion of the portfolio.

When looking at a 60/40 split 60% stock 40% bonds, generally I’ll use a properly structured IUL policy to replace the Bond portion of the portfolio.

Typically, the bond portion of a portfolio is supposed to be the safe portion of the stock portfolio… but ask Silicon Valley bank how that worked out for them!

You still have risk of loss with the bond portion of the portfolio and that’s one of the reasons why I like to use an IUL or even an FIA to replace the bond portion of a portfolio.

With a cash value life insurance policy there’s multiple strategies you can use to accomplish tax free income distributions during retirement.

A cash value policy shouldn’t be the only tool used for tax free income. However, it does play a vital role in a comprehensive tax-free strategy to help ensure you reach the zero percent tax bracket. (Or the lowest tax bracket possible)

With a cash value life insurance policy your money will grow tax-free and during retirement you can access this money tax free!

One advantage a cash value life insurance policy has in relation to removing money from the account is this: When you remove money from a cash value life insurance policy the recommend method is to remove the money via a wash loan which makes it a free loan. Because the money is removed as a loan and not a withdrawal the insurance company credits interest to the entire account value including the loaned money. This method allows your income to stretch or last longer than if you were withdrawing the money.

Also, if there is a downturn in the market you don’t have to worry about the sequence of returns risk. In fact, retires who choose to leave a major portion of their retirement portfolio in the market and then experience a drop in value do to a market downturn, these individuals are able to reach into their cash value life insurance policies to restore their account values, more on that in just a moment.

The sequence of returns risk is a very real threat to your retirement income. If you follow the 4% rule you have a 90% chance of not running out of money at least they say. So if you have a stock portfolio balance of $1,000,000 the 4% rules says, if you only withdrawal 4% of the account balance then you’ll have a reasonable chance of not outliving your money. However, a few years ago many economists and financial analyst such as Dr. David Babble & Dr. Wade Pfau started sounding the alarm advising against the 4% rule suggesting this number should be closer to 3%’

Instead of withdrawing $40,000 each year from your portfolio, only withdraw $30,000 from your One Million account.

With these accounts you don’t have the luxury of stretching your account values like a cash value life insurance policy. When you start withdrawing income, you’ll instantly start reducing your account value. If you also experience a 40% reduction due to a market decline while also reducing your account value for living income, you’ll experience what’s called the sequence of returns risk. Your losses are compounded by the simultaneous drawdown of income distributions. Another way of saying it is this: You’re going to run out of money faster and you’ll never recover your losses. Add insult to injury with rising future taxes and you have a retirement time bomb waiting for your arrival into retirement.

If you’ve implemented a cash value life insurance strategy as part of your comprehensive retirement plan, you’ll enjoy tax free income lasting your entire life and what’s left when you die will pass on to your heirs.

If you implement a modified version of a tax-free cash value life insurance plan and accumulate at least 4 to 6 years of income you’ll be able to hold firm when the market takes a U-turn.

For example. Let’s say you have $200,000 in your cash value life insurance policy and you are taking taxable distributions of $52,000 each year in a 22% tax bracket with a take home of $40,000.

In year 4 of retirement, you lose 33% of your taxable portfolio. Instead of taking a distribution during a down year, you can pull $40,000 income tax free from your life insurance policy allowing your portfolio time to recover without you touching any of the funds. If the market is down for a 2nd consecutive year pull another $40,000 income tax free from your life insurance policy. With the market on the rebound the following year you can return to your normal distributions from your taxable portfolio.

Another way to look at is this: You start off with an account balance of $1,000,000 and after a few years of distributions your account value is down to $800,000. You got to bed at 10:30pm with $800k and wake up at 8am with $650,000. Overnight due to a market downturn you lose $150,000. You’re already on a fixed income and you certainly need every dime of distribution but after losing $150,000 you can no longer pull out the same amount of money and maintain the same income longevity. You have two options, reduce your withdrawal to account for the $150,000 decrease in account value or maintain your same distributions while speeding out depletion of your account.

Over a 20-year retirement life span you should plan for at least 3 down years, and that’s why I recommend at the minimum implementing a modified version of a tax free cash value life insurance plan and accumulate at least 4 to 6 years of income you’ll be able to use and hold firm when the market takes a U-turn.

The second strategy using the modified cash value life insurance plan is this: Even if you don’t experience any down years due to a market decline, you’re almost guaranteed to see a decline in take home pay due to higher future taxes.

If you find yourself having to pay higher taxes to the tune of an extra $1,000 per month $12,000 per year you can simply reach into your cash value life insurance policy each month to cover the difference. A $200,000 cash value balance would cover you for 17 – 26 years removing only $1,000 per month income tax free to account for the higher taxes.

Life insurance isn’t just for when you die, a properly structured cash value life insurance (An IUL is my CVL of choice) can provide you with peace of mind retirement helping to safeguard against running out of money in retirement.

With proper planning a cash value life insurance can play an important role in helping you to reach the zero percent tax bracket. As a matter of fact, the “Father IRA’s, Ed Slott” actually stated a Roth IRA and a Cash Value Life Insurance policy can single-handedly remove any taxes you or your beneficiaries will have to pay.” That’s a very strong statement coming from someone of his stature.

Use a cash value life insurance policy for tax free income during retirement to help safeguard against the Great Tax Risk and the Great Market Risk! At the very minimum stock up 4 to 6 years of income to help safeguard against a future tax hike or market downturn!

Cash Value Life Insurance Plays a Vital Role In Tax-Free Income For Life!

Pay zero taxes on your HECM Distributions During Retirement.

Using an HECM Line of Credit, pre-retirement and during retirement can drastically increase your total cash flow.

An HECM line of credit allows you to eliminate your mortgage payments while also creating a tax-free supplement to your retirement income.

Eliminate mortgage payments

Create an Emergency fund

Use as income allowing you to delay distributions from taxable accounts,

Use to delay distributions from social security and as a result increases your social security income by 8% each year until age 70 For example: Assuming a payout of $1,948 monthly starting at age 65. If you wait until age 70 the monthly payout could be $2,775, which is almost $10,000 more per year. Having the funds to delay social security benefits until age 70 could provide you an extra $10,000 per year in retirement. Use the tax-free funds in your HECM line of credit to help replace social security income until age 70. This strategy could give you almost $10,000 more in retirement.

Social Security Calculator: Estimate Your Benefits (aarp.org)

Funds inside of your HECM line of credit are tax-free and don’t count as provisional income! This income bridge, could allow you to move more money into a tax-free bucket allowing you to avoid taxation of your social security income.

The HECM line of credit money is income tax free, so you’ll avoid moving into a higher tax bracket, in many cases withdrawing money from your “HOME-HECM” account will allow you to lower your tax bracket.

Helps avoid the sequence of returns risk. When the market is down, instead of receiving distributions from your market account thus depleting funds faster during a downturn in the market, instead you can access these funds income tax free and avoid pulling money out of your brokerage accounts thus allowing the market time to recover. Once the market recovers you can resume distributions from your taxable and tax deferred accounts.

An awesome income tax reduction strategy is a Roth IRA conversion, some people call it a back door Roth IRA. The goal of a Roth IRA conversion is to reposition money from your tax & tax deferred accounts into a tax fee account (Roth IRA). With income taxes expected to rise significantly in the future, this strategy allows you to reposition funds paying taxes at today’s historically low rates to avoid paying taxes on the same amount of money when taxes will be much higher in the future. You can simply pay the taxes owed from your savings or checking accounts or use tax-free funds from your HECM line of credit to pay the taxes on this Roth IRA conversion.

These funds can be used to cover long-term care needs. You can withdraw money income tax free as needed or you can withdraw a lump sum & then convert this lump sum into an asset-based long-term care annuity. An asset-based long-term care annuity can 2.5X your face value amount if age 70 or older, if age 40-60 the asset-based long-term care annuity can 4X your face value amount. For example, if you have over $100,000 in your HECM line of credit (which is income tax free) you can pull out $100,000 and purchase the asset-based long-term care annuity @ 2.5X which would give you $250,000 for long-term care services all accessed income tax free!

If you choose not to follow any of these tax-free savings’ strategies using the HECM line of credit, at the very least you can increase your cash flow by eliminating your mortgage payment while also creating an emergency side fund, income tax fee.

Many people ask how are the funds income tax-free!

Removing money from your HECM line of Credit is similar to removing money form a cash value life insurance policy.

When you remove money from your cash value life insurance policy, you do so by way of a loan. The IRS doesn’t count loaned money as a taxable source, and this allows you to remove money from your cash value life insurance policy tax-free during your entire retirement lifetime. The benefits left will pass on to your heir’s income-tax-free.

The HECM line of credit is also considered a loan thus avoiding taxation of withdrawals.

The value of the home grows regardless of the HECM line of credit. The HECM line of credit has guaranteed growth, regardless of the home value growth.

If after 30 years of retirement you die peacefully in your sleep, your beneficiaries will have multiple options to secure the home.

- The lender will offer your beneficiaries the opportunity to refinance the home in their name.

- The lender can sell the home and give your beneficiaries the excess value. For example: If $300,000 was used for the HECM account and the selling value is $600,000 30 years later when you die, the lender will sell the property for $600,000 giving your beneficiaries $300,000.

- Your beneficiaries can use life insurance proceeds to purchase and pay off the home.

These same scenarios would apply if you had to move into a nursing home minus the life insurance paying off the home unless your life insurance policy also had a chronic illness benefit.

If you had a life insurance policy with a chronic Illness living benefit (let’s, say a benefit of $890,000 from a $1,000,000 policy). The policy would pay up to $890,000 income tax-free as a result of needing long term care services, you could use $300,000 to pay off the mortgage, $390,000 to pay for nursing home expenses, $200,000 an inheritance to your beneficiaries along with an additional $110,000 of death benefit going to your beneficiaries.

An HECM or Reverse Mortgage done correctly can play a vital role in helping you to reach the zero percent tax bracket.

The majority of the So-called gurus speaking ill of reverse mortgages do so simply because they have misinformation, however many economist and financial analysts such as Dr. Wade Pfau and others, who’ve completed many hours of reverse mortgage research all concur, Reverse Mortgages can be a powerful tool to assist in retirement.

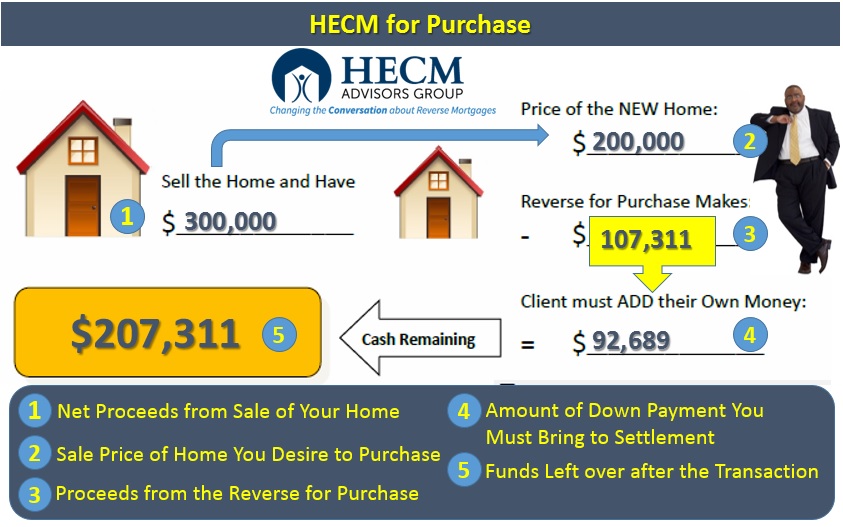

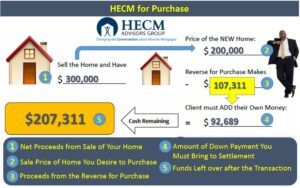

Did you also know you can use Reverse Mortgage to purchase a new home? A HECM For Purchase?

Take a look at this example done by Don Graves, an HECM Expert.

Meet Bill and Harriet

Basic Metrics

- Bill retired last year and gets a small pension and Harriet’s had some health challenges and will need to retire within 6 months. Both are drawing on Social Security

- They have $200,000 in cumulative savings (IRA, 401K, Annuities)

- They believe they will need to draw about $17,000 a year from those savings if they want to maintain their basic lifestyle.

- They have a home worth $389,000 and it has a small mortgage of $75,000 which they pay $500 a month with about 20 years remaining.

The Housing Wealth Conversation

Advisor Asks, “Bill and Harriet, would it be OK if we increased your monthly cash flow, reduced your expenses and added $200,000 back into your retirement savings?” Client Says: “(fill in the blank)”

The Simple Strategy

- Sell their existing house, (thus eliminating mortgage and payments)

- By doing just this, we have freed up $500 a month in cash flow or $6,000 a year. This reduces their initial withdrawal rate from 8.5% to 5.5%.

- They now have around $300,000 in proceeds left over from the sale of the home.

- They purchase a new $200,000home but use the HECM for Purchase to do this vs. using all their proceeds.

- This strategy will provide Bill and Harriet with around $207,000 left over to add back into their retirement savings.

- Now theirtotal retirement savings are $407,000 of which they are withdrawing $11,000 a year initially, which is a 2.7% withdrawal rate.

At the end of the day, Bill and Harriet have no monthly mortgage payments, a new home, lower taxes, lower maintenance, newer appliances and $407,000 in retirement savings, all because their new advisor knew something that the old one didn’t.

If you would like more information on HECM’s we’ll be happy to get you in contact with:

Don Graves, RICP®, CLTC®, Certified Senior Advisor, CSA®

President and Chief Conversation Starter at HECM Advisors Group/Institute

Don Graves, RICP® is a Retirement Income Certified Professional and one of the Nation’s Leading Educators on the Emerging Role of Reverse Mortgages in Retirement Income Planning. He is president and founder of the HECM Institute for Housing Wealth Studies and an adjunct professor of Retirement Income at The American College of Financial Services. He has helped tens of thousands of Advisors as well as more than 3,000 personal clients since the year 2000!

Don Graves is the industry go to for Reverse Mortgages -HECMs

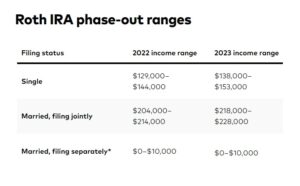

Pay zero taxes on your Roth IRA Distributions During Retirement.

Roth IRAs

All you need to know about Roth IRA’s is “Tax-Free – Tax-Free-Tax-Free!

Roth IRAs were created by the Taxpayer Relief Act of 1997 and went into effect in 1998 initially you could only contribute $2,000, fast forward to 2023 you can now contribute $6,500 each year and if over 50, you can contribute an additional $1,000 for a total of $7,500.

It’s my belief Roth IRA contributions will continue to rise as a result of an out-of-control national debt of 31.5 Trillion.

With a typical tax deferred account such as a 401k or regular IRA, you’re planning for your Uncle Sam’s future retirement by delaying taxes at a lower rate so that your uncle can tax you at a higher tax rate when you retire.

Think about it, why else would your uncle force you to withdraw your money by age 72, and if you refuse to do so or you forget, your great Uncle Sam will remind you with a 50% tax penalty!

RMD’s or required minimum distributions exist for the benefit of the government your uncle Sam!

This has been a long-standing strategy of funding the government into the future. However, with out of control spending a national debt of $31.5 trillion for a total $108 trillion in unfunded obligations Uncle Sam is now looking for ways to get more money now!

The goal is always to encourage people to save for retirement so you can be less dependent on assistance when you stop earning an income but with out of control spending the government is becoming more and more dependent upon your future tax dollars and your today tax dollars.

Increasing Roth IRA contributions helps to encourage more retirement savings while also securing more tax dollars TODAY!

The Roth IRA is an awesome underused tax-free retirement tool it’s one of the main components of a complete tax-free retirement strategy.

For most people it makes sense to contribute the maximum amount into a Roth IRA for tax free enjoyment in the future.

Roth IRAs don’t have RMDs required minimum distribution shackles and can pass on to your heir’s income tax free!

Distributions from Roth IRAs don’t count as provisional income, is not counted in the social security taxation formulary, and doesn’t count towards the IRMA surcharge.

If you are pulling $100,000 each year from your Roth IRA these funds will not trigger higher social security taxes…. But if you pull $100,000 from your 401k or IRA, you’ll almost certainly be required to pay taxes on up to 85% of your social security income. Remember ½ of your social security income is counted as provisional income for taxation purposes.

This $100,000 withdrawal from your 401k or IRA will also result in you paying higher Medicare premiums by way of the IRMA surcharge. Finally, if the goal is to leave your 401k or IRA as an inheritance because you don’t need this income for your retirement lifestyle, well your good Ole’ “Uncle Sam” has a different plan for you in the form of a 50% tax penalty!

I always like to say… Whose Retirement Are You Really Planning, Yours Or Your Uncle Sam’s?

There’s never been a more important time in the history of our country to work on a tax-free retirement planning strategy than now!

Contributing to a Roth IRA must play a vital role in your retirement future, your future self is counting on it!

If you like to enjoy ice cream with your cake, make sure you also take advantage of a Roth 401k. With Secure Act 2.0 RMDs on Roth 401k accounts are gone.

A Roth IRA allows you to contribute after tax money with tax-free growth and tax-free lifetime withdrawals to include tax-free withdrawals of the gains. A 401k / IRA is the opposite, these accounts allow you to contribute pretax with tax deferred growth along with taxable withdrawals.

Let’s look at this example of tax deferred versus tax free growth.

Let’s assume you contribute $21,164 pretax into a tax deferred 401k or IRA with no employer match. Let’s also assume a 10% rate of return for 30 years with no other contributions for easy math. This scenario also assumes a 25% tax bracket before and after retirement. We’re also not accounting for management and fund fees.

After 30 years of 10% growth the account value would equal $419,838.72 the after-tax account value would be $314,879.04 assuming the same 25% tax bracket.

With the second example we’ll invest the same amount but only this time will pay with after-tax dollars. Assuming the same 25% tax bracket our after-tax contribution into a tax-free bucket will be $15,873 with a 10% rate of return for 30 years assuming the same 25% tax bracket before and after retirement.

$21,164 x 25% = $5,291.

$21,164 – $5,291 = $15,873

$15,873 with the same 10% rate of return for 30 years = $314,879.04 income tax free which is the same amount you’ll receive after paying 25% taxes with the pre-tax, tax deferred 401k account.

The tax deferred 401k / IRA has no advantage overpaying taxes at today’s rate and investing in a tax-free tool assuming the same tax bracket before and during retirement.

The benefits of tax-free certainly outweigh the benefits of tax deferred when all things are equal, however in the real world all things are not equal. The national debt is 31.5 trillion with a total debt of $108 trillion in unfunded obligations.

If we go back to our scenario above and our future tax bracket is 15% higher the numbers become depressing for the tax deferred buckets. Instead of $314,879.04 after tax we now only have $251,903.23 after tax.

When looking at a full portfolio of $2,000,000 in a tax deferred versus tax free, the numbers is even more scary.

With a 15% tax bracket increase the $2,000,000 would be $1,200,000 while the tax-free bucket account would be $1,500,000 this a huge $300,000 difference in real money received, this is a $300,000 mistake.

If your guaranteed income is $50,000 in a 22% tax bracket and 5 years into retirement the government raises the taxes by just 8% your after-tax income will drop from $39,000 down to $35,000! What if instead of raising the taxes by 8% congress raises the taxes by 20% at year 15 in retirement that’s a reduction of $22,000 along with an after-tax income that started at $39,000 before dropping to $35,000 before dropping to $28,000. The overall income you receive is staying level but the income you get to keep is steadily dropping.

Securing a large portion of your retirement income in multiple tax-free buckets will help shield you from what I call “The Great Tax Risk.”

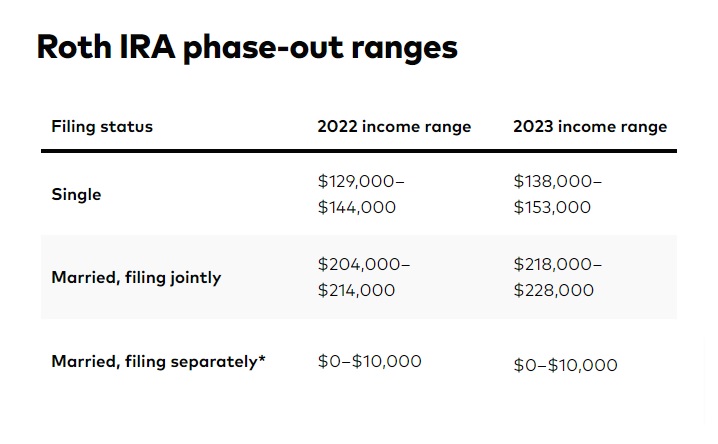

Limitations of the Roth IRA prevent you from contributing more than $7,500 if married filing jointly over 50 and limit you from participating in a Roth IRA if are single and earn more than $153,000 and $228,000 if married filing jointly.

For those who would like to take advantage of Roth IRA but don’t qualify due to being a high earner, the next section is for you.

In the next section I’ll show you how to enter a Roth IRA via the backdoor!

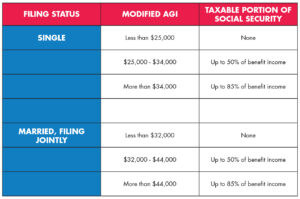

Pay zero taxes on your Social Security Distributions During Retirement.

No Taxation Of Your Social Security Income

It’s all about your provisional income!

If you can get your provisional income low enough, you’ll owe zero taxes on your social security income.

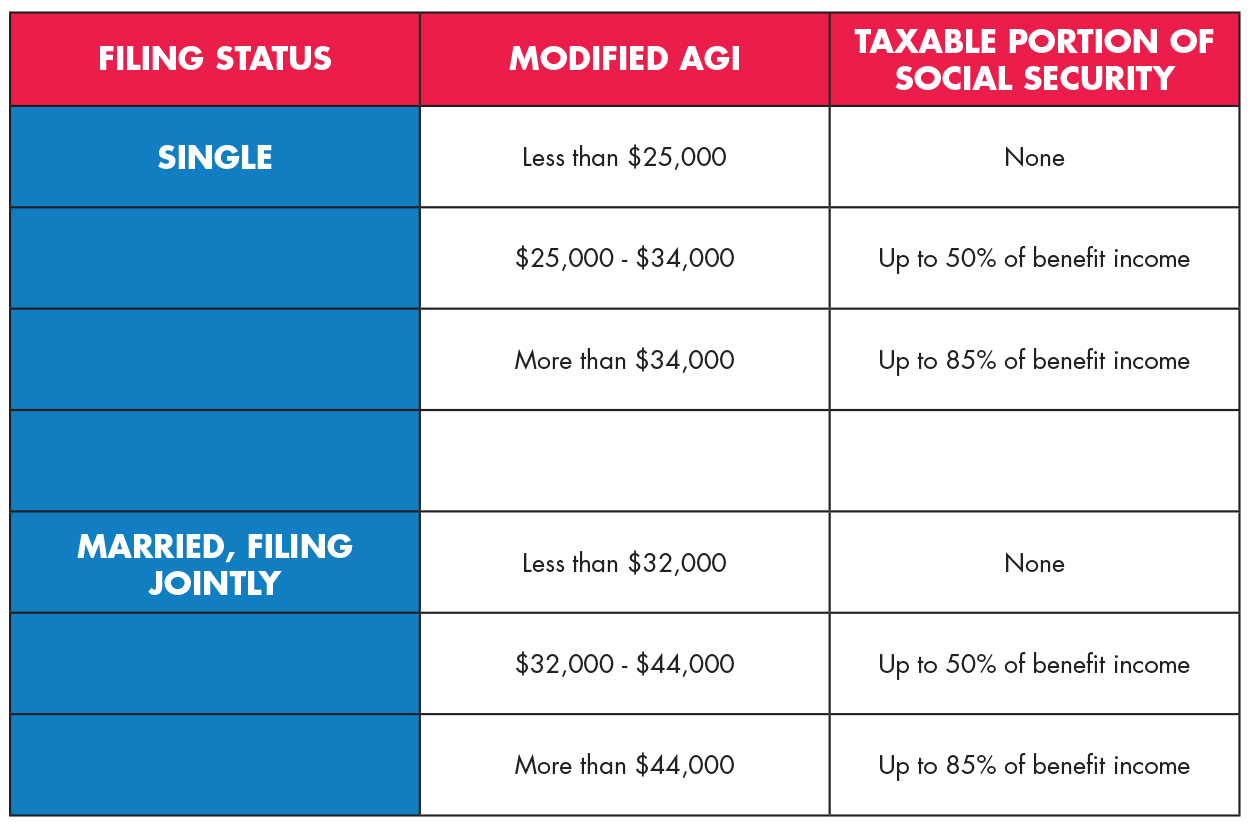

In 2023 in order for a married couple filing jointly to avoid taxation of their social security income, they’ll need to earn $32,000 or less in provisional income and please keep in mind that ½ of your social security income counts towards your provisional income.

For example lets say you earn $60,000 in provisional income along with a social security benefit of $30,000. The income the IRS counts as provisional income in this scenario is $60,000 plus $15,000 for a total of $75,000. $75,000 certainly puts you over the $32,000 limit of zero taxes, it also puts you over the 50% taxation threshold of $32,000 to $44,000 and puts you over the 85% taxation threshold of $44,000 by $31,000.

One strategy for this couple would have been to execute a Roth conversion moving tax deferred monies into tax free buckets without provisional income standards.

Avoiding taxation of your social security benefits doesn’t start when you turn age 65, this strategy starts the sooner the better and at the very latest by age 59 1/2

As you grow wealth using the various financial tools, working with a qualified financial professional can help you optimize the right amounts of income going into the various financial buckets.

A financial professional only recommending stock growth products might not have a conversation about having the right kind of allocation for your comprehensive financial plan. A life insurance only professional only recommending life insurance only products probably isn’t having the right conversation with you about having the right allocation for your comprehensive financial plan. Obviously, there’s exceptions to these statements on both sides of the table.

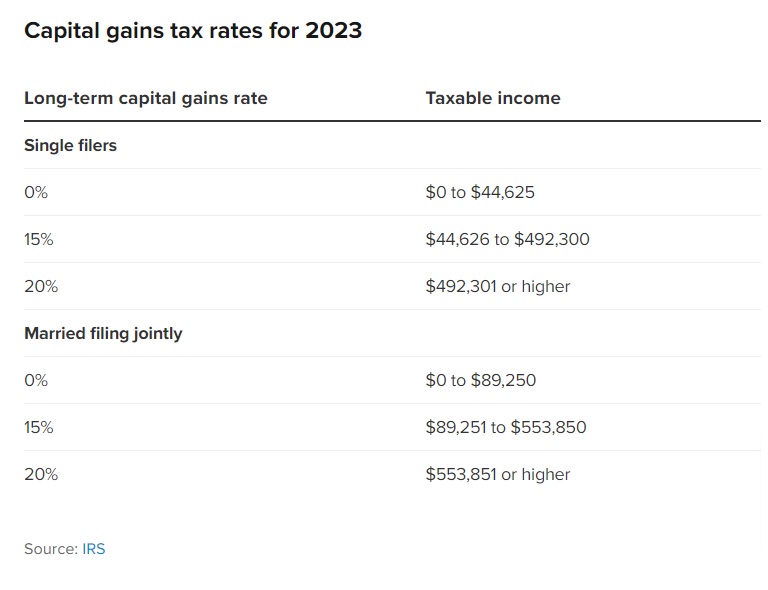

Avoiding taxation of your social security income requires future tax-free bucket planning that must occur early in your working years for optimal results.