GAMBRELL FINANCIAL NEWS

YOUR TRUSTED FINANCIAL info center

We’ve been working at our best to ensure our clients’ financial future, and to provide the best financial services possible. We stand for quality and credibility, so you could be sure about our work.

TOP-RATED FINANCIAL NEWS

Don’t have time to read, you can listen to our podcast at: https://www.redzonetoolbox.com/

Have a topic you would like more clarity on send us an email: info@gambrellfinancial.com

Retain Key Employees w/A Bonus Plan

Overall, the Section 162 Executive Bonus Plan is an effective way to retain key employees and provide an additional layer of benefits. The plan is straightforward to implement and can be customized for each executive. The employee ownership of the policy and policy values provides financial flexibility, and the tax-deferred growth on accumulations and tax-free death benefit make it an attractive option.

- Retain Key Employees

- Payback Agreement

- The employer may enter into a side agreement with the employee that states if the employee leaves the employer’s employment prior to a certain specified date, the employee will be required to pay back the bonuses received.

- Vesting Schedule, The employer can provide a vesting schedule whereby if the employee leaves the company prior to full vesting, the employee will be required to pay back the unvested amount.

- Tax Impact Under a Section 162 Executive Bonus Plan, the employee takes each year’s bonus into taxable income as received or when the premium is paid by the company. Some companies will gross-up or pay an additional bonus for projected income taxes and payroll taxes attributable to the bonus. Since the employee owns the life insurance policy or non-qualified deferred annuity, they will have access to policy values.

- The only exception to the bonus being deductible is if the IRS would rule that the employee’s total compensation is unreasonable. If that is the case, the employer would be limited in how much they can deduct but the employee would still take all of the compensation into taxable income.

- Employer selects which executives they wish to benefit

- Employer chooses benefit level and can customize for each executive

- 162 Executive Bonus Plan easy to implement and administer

- No administration other than regular payroll

- Bonuses may be fully deductible to employer under IRC 162

- Rewards and retains Key Employees

- Plan can be terminated by company at any time

- Employee owns the policy and policy values

- Employee gets to name beneficiaries

- Accumulating values can be accessed by employee

- Tax-deferred growth on accumulations

- Tax-free death benefit in case of life insurance

- Life insurance can benefit survivors and pay estate costs

- Cash values available for emergencies

- Cash values may be used to supplement retirement income

“Life Insurance You Don’t Have To Die To Use”

“Life Insurance You Don’t Have To Die To Use”

With this kind of plan, you get to be the beneficiary of your own policy. Many Americans over the age of 30 are on some kind of prescription drug.

Life Time Retirement Income Guaranteed*

Guarantee yourself a lifetime of income. Protect your principle- keep your money safe

Do you have a plan to never outlive your retirement money?

Did you know that an FIA, Fixed Index Annuity can provide you with an income you can never outlive guaranteeing you never lose any of your money!

An FIA can provide you with the peace of mind retirement you deserve. A fixed indexed annuity allows you to have an insurance contract that protects you against outliving your retirement nest egg. If you are in the “Retirement Redzone” age 50-75 you can’t afford another “Stock Market Loss”.

What happens if you are 62 and the market crashes? Do you think it’s realistic to recover a 44% account value drop 3 years before retirement? What if the market crashes after you’ve been retired for 5 years. Will your health allow you at the age of 70 to go back into the workforce?

When the market crashed in 2002 it took 13 years just to make a 1$. It took 13 years before recovering what you lost plus $1.

It’s mathematically impossible to recover a 20% – 44% loss in account value while also withdrawing money to live on!

With an FIA, your contract account balance doesn’t decrease during a time of market loss. You will not earn any interest during a market loss but most importantly you will never lose any money! When the market recovers the interest crediting will continue.

For example: In a typical market account, let’s say you have 1 Million. For simple math let’s also say you have 1 Million in an FIA Fixed Index Annuity.

If the market drops 44% but you only lose 35% this means your 1 Million account value drops to $650,000.

With the Fixed Index Annuity, you have what’s called a ZERO Percent floor. This means the least amount of money you will earn during a market decline is zero percent.

Using the same scenario as above, if you have a 1 Million account value and the market drops the same 44%, guess what happens?

You’ll still have the same 1 Million account value because you can’t lose any money due to market losses.

The price for having this retirement safety net is this…. You can’t have unlimited gains if you remove the risk of market loss.

With a Fixed Index Annuity, you have what’s called an Annual reset or annual point to point crediting.

At the end of each term your money is locked in place so it can never go backwards due to market losses.

You can only go up from the amount of interest credited based upon a percentage of market gains, and you never go back from a market loss. Every term, your contract account value gets locked into place, and it can’t go into reverse

The amount of interest in a fixed index annuity will be limited based upon caps and participation rates as defined in the annuity contract.

In exchange for receiving an income guaranteed for the rest of your life, the insurance company will limit the unlimited interest you could earn in the market, that way they can guarantee you’ll never lose any money!

Because a Fixed Index Annuity is an Insurance product and doesn’t directly invest in the market. The insurance company using what’s called mortality credits along with other crediting options, are able to provide you with a higher payout dollar per dollar than what you would receive with a typical market account.

In other words, you don’t have to accumulate the same amount of money in a FIA to equal the same payout as a typical market account.

Assuming the 4% Rule you would need a 1 Million account value at retirement in order to receive $40,000 of income with an 88% – 92% chance of not running out of money.

With a Fixed Index Annuity and as a result of mortality credits you would only need $600,000 to provide you with the same $40,000 of income while also eliminating the possibility of you running out of money.

With a Fixed Index Annuity, even if the account balance goes to zero, you will continue to receive the same income forever, guaranteed!

A Fixed Index Annuity isn’t for everyone, and you shouldn’t move all of your money to an FIA.

My rule of thumb is this…. The amount of money you need to pay the bills, keep food on the table, pay for transportation cost along with medical cost, the monies needed to ensure these basic needs are covered, should be guaranteed with an FIA! The monies you don’t need to cover basic needs can be left in market products.

Guarantee the core and have fun with the rest.

Obviously the scenario used in this example is not a representation of your situation. The only way to determine if any of the information would benefit you is to schedule a one-on-one face-to-face meeting with myself or a member of my team.

True Cost Of Home Ownership

Our unique Health Insurance Savings Strategies has helped small business owners, families and individuals save millions of dollars in health insurance premiums using our “Gap Insurance For Health Insurance Strategies. You can even pay for your individual health insurance with tax free money!

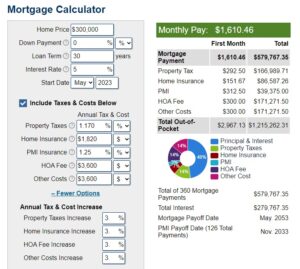

With PMI

$300,000 Home assuming zero down.

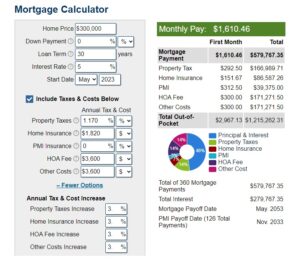

NO PMI

$300,000 Home assuming zero down.

After 30 years with an average growth of 3% the home would be worth… $728,178.74

FIA - Annual Point-to-Point with a Cap

FIA – Fixed index annuities offer the possibility of capital gains during favorable market conditions, while simultaneously eliminating downside risk during unfavorable ones.

Point-to-point serves as a straightforward interest crediting strategy utilized to calculate growth within an index annuity. Annual point-to-point provides a suitable option for investors seeking to minimize mid-year market volatility.

This technique involves the insurance company comparing the index price at the end of the index term to its price at the beginning of the term for one year.

In the event of a price increase, the interest credited to the contract equals the percentage of the index price increase, up to a cap or participation rate. Conversely, interest credited is zero percent in the event of a decrease, thereby precluding any loss. Caps tend to fluctuate up and down over the course of an annuity contract’s duration, often tracking treasury rates.

Potential buyers should ascertain the contractual minimum caps and participation rates before purchasing an annuity.

Some fixed index annuities offer uncapped crediting strategies, where there is no limit to how much can be earned. However, there may be a spread, a percentage deducted before gains are credited. In this example, we have the same 20% index gain with 150% participation rate and a 5% spread. In this case, we are participating in one and a half times the index gain – or 30% – minus the 5% spread – so we would be credited with 25%. If the index was up 4%, we would participate in 6% growth, and after the 5% spread, we would be credited with 1% gain.

Charitable Remainder Trusts (CRTs)

Charitable Remainder Trusts (CRTs) funded by insurance-based Wealth Replacement Trusts are a strategic approach to reducing significant long-term capital gain taxes. The Health Care Act of 2010 implemented a 3.8% tax on investment income for single individuals and married couples filing jointly, earning over $200,000 and $250,000 respectively. The proposed solution is to contribute some or all of the stock from the asset the individual intends to sell to a charitable trust. The proceeds from the sale of the stock in the charitable trust are tax-free, allowing the individual to invest more money in the charitable trust, increasing their income and paying out income to beneficiaries.

The contribution generates a charitable tax deduction that can offset ordinary income or other capital gains from the remaining stock that is not donated to the charitable trust. The size of the deduction depends on the age of the beneficiary, the amount of the trust payout, and the type of property contributed. The charitable tax deduction can be used within the contribution year, with a five-year carry-forward of any unused deduction.

The increased income from the charitable trust allows for the contribution of a portion of the income to an irrevocable life insurance wealth replacement trust, benefitting children or loved ones by replacing the value of the asset or a portion of the value. The Signature Guaranteed Universal Life Policy or Signature Performance Indexed Universal Life Policy are potential candidates for funding the trust.

Selling a business or significant asset through this transaction reduces substantial taxes, shelters sales proceeds, and provides a more substantial income than would have been available after taxes. This approach also enables individuals to contribute to their favorite charity through a significant benefit at their death. To avoid being taxed on the proceeds personally, the individual must contribute the stock to the charitable trust before receiving a sales contract on the business.

For those considering selling their business or a large block of publicly traded stock with charitable interests, this strategy can help to accomplish their life goals while benefiting their chosen charity and loved ones.

Social Security Income. How it works!

The Social Security program was established to provide a financial safety net for retired and disabled workers and their families in the aftermath of the Great Depression. It is mandatory and requires most wage earners to contribute a percentage of their annual income to support the program, with 6.2% of earned income being withheld for Social Security and an additional 1.45% for Medicare.

Employers also contribute an equal amount. Social Security benefits are available to retired, disabled, and surviving workers and their families.

Individuals born before 1938 are eligible to collect full Social Security benefits at age 65, while those born after 1938 will experience a gradual increase in the Normal Retirement Age (NRA) from age 65 to 67. Surviving spouses are entitled to benefits based on their deceased partner’s earnings history unless they would receive more based on their own history.

Once individuals begin receiving retirement benefits, they may need to include them in their taxable income reported to the IRS. Federal income tax on Social Security benefits is owed if the total income for the year, including half of Social Security and tax-exempt earnings, is greater than $32,000 ($25,000 for single taxpayers). The IRS provides a worksheet to calculate the amount of taxable income.

It is essential to maintain an accurate record of Social Security earnings. This record can be obtained from the Social Security Administration (SSA) by filling out Form 7004 and mailing it to the SSA. If errors are discovered, evidence must be provided for correction. It is recommended to check earnings records every three years to catch and correct any issues early on.

This material is for informational purposes only and should not be construed as tax, legal, or investment advice. While the information is believed to be reliable, individual situations can vary, and professional advice should be sought when making decisions.

The Advantages of Delaying Social Security Benefits

The Advantages of Delaying Social Security Benefits

The decision to delay claiming Social Security benefits can be a smart financial move, but it is important to consider the statistics and your individual circumstances. Assuming you have earned the maximum level of Social Security benefits throughout your career, waiting to claim benefits can result in significant increases in your monthly check.

For example, if you were to claim benefits at age 62 in January 2022, your monthly retirement benefit would be $2,364. Waiting until age 67 to claim benefits would increase your monthly check by nearly 51% to $3,568. And if you were to delay claiming benefits until age 70, your monthly check would be over 17.5% higher at $4,194.

However, it is important to consider what your cumulative benefits will be. At age 76, the cumulative benefits for claiming at age 67 will exceed those for claiming at age 62. And at age 87, the cumulative benefits for claiming at age 70 will top those for claiming at age 67.

Additionally, the average lifespan for men in the U.S. is 75, and 81 for women. For many Americans, delaying claiming benefits until age 70 may not pay off because they will not live long enough to see the increased benefits. However, for those who live to age 65, the average life expectancy is another 19.1 years for males and another 21.7 years for females, which may change the decision-making dynamics.

Considering the time value of money, even if you do not need Social Security benefits at age 67, you could claim them and invest the money in a low-risk alternative such as Treasury bonds. This could further justify delaying claiming benefits.

Ultimately, the decision to delay claiming Social Security benefits should be based on individual circumstances and factors such as life expectancy, financial needs, and investment opportunities.

How to Transfer a Family Business to the Next Generation

The longevity of a family business can be ensured by establishing a clear and concise plan for its future, including the transfer of ownership to the next generation. This strategy is aimed at preserving the integrity of the business and avoiding unexpected tax liabilities. There are four methods to transfer a business to children: outright gifting in a will, gift giving, selling the business, and transferring the business to a trust.

The use of a grantor trust is advantageous because it avoids various taxes on assets and interest payments.

In situations where multiple children are involved, it is important to plan ahead for unforeseen events like death or incapacitation. The use of a Buy-Sell Agreement can ensure shares are reassigned legally if a business partner dies or is incapacitated. This legal contract provides an indirect control mechanism for the original owner and facilitates the transfer of remaining shares to children working in the family business.

In cases where children have varying levels of interest in the business, it is crucial to tailor the transfer plan to each child’s level of engagement. The use of life insurance to purchase remaining shares from the estate is an effective way to equalize the estate. The owner should also consider taking liquid assets and putting them into a deferred annuity to optimize tax savings.

In summary, the transfer of a family business requires a thorough and precise plan to ensure a successful transfer to the next generation. The available options can be tailored to the specific needs of the business, the family, and their goals.

Strategic Business Planning Buy-Sell Planning

Strategic Business Planning Buy-Sell Planning

Strategic Business Planning Buy-Sell Planning

The continuity of any business depends on a well-conceived plan for the transfer of ownership in the event of death, disability, or retirement of the owner. Unfortunately, many entrepreneurs have yet to develop a viable succession plan for their enterprises, leaving their future in jeopardy.

A proficient Buy-Sell Agreement can provide an orderly transition of ownership from one proprietor to another. However, a funding mechanism must be established to cover the withdrawing owner’s share of the business. American National’s life insurance products offer cost-effective and tax-efficient methods of financing Buy-Sell Agreements.

Business Planning

The implementation of life insurance and annuities may offer various solutions for business owners. Life insurance policies may be utilized to entice promising talent, safeguard the business against the loss of key staff members, or engender loyalty among employees by providing financial security to their loved ones. Additionally, life insurance and deferred annuities can furnish supplementary benefits to valued personnel.

Understanding Capital Gains Tax

Understanding Capital Gains Tax

A Comprehensive Overview of Capital Gains Taxation

The Jobs and Growth Tax Relief Reconciliation Act of 2003 offers taxpayers the chance to reduce their taxes by generating long-term capital gains or acquiring dividend income. However, it is important to note that “sunset provisions” have been put in place, which means that tax rates on capital gains and dividends may increase again if Congress does not act to extend the rates. As of now, the lower rates are only valid until 2010.

The Taxation of Long-Term Capital Gains

Under this act, the tax rate for most taxpayers on net capital gain cannot exceed 15%, while taxpayers in the 10% and 15% tax rate brackets are subject to a 5% tax rate for property sold or otherwise disposed of after May 5, 2003 (and installment sale payments received after that date). This reduced rate applies for both the regular tax and the alternative minimum tax.

(Note: Higher rates that apply to unrecaptured section 1250 gain, collectibles gain, and section 1202 gain remain unchanged.)

The Tax Treatment of Capital Losses

If you incur losses from selling a capital asset, you may deduct those losses to the extent they equal capital gains from selling other assets. If your losses exceed your gains, you can only deduct up to $3,000 ($1,500 if married and filing separately) of capital losses in a tax year against other income on Form 1040. You may carry losses forward and continue to deduct $3,000 ($1,500 if filing separately) annually against other income until your losses are exhausted.

It is important to note that the information discussed herein is for general illustration and informational purposes only. It should not be construed as tax, legal, or investment advice. Although the information has been gathered from reliable sources, individual situations may vary, and as such, it should be relied upon only when coordinated with professional advice.

Longevity Risk Avoid Running out of Money During Retirement

Longevity Risk Avoid Running out of Money During Retirement

Longevity Risk: Avoid Running out of Money During Retirement by Using an FIA

Are you nearing retirement age and worried about the risk of running out of money? If so, you are not alone. For many Americans, the thought of outliving their retirement savings is a major concern. But the good news is that there is a solution to this problem: a Fixed Index Annuity (FIA).

As an expert in the retirement planning industry, I have seen firsthand the impact that longevity risk can have on retirees. Sequence of returns risk, sequential withdrawal risk, living too long, outliving retirement income, and stock market losses during retirement are all factors that can contribute to the risk of running out of money. But with an FIA, you can protect your retirement income and avoid this risk altogether.

So, what exactly is an FIA? It is a type of annuity that allows you to participate in the potential growth of the stock market while protecting your principal from market losses. With an FIA, you can lock in gains during good years and never lose money during bad years. This means that you can enjoy the peace of mind of knowing that your retirement income is safe, regardless of what happens in the stock market.

But the benefits of an FIA don’t stop there. In addition to protecting your retirement income, an FIA can also provide you with a lifetime income stream. This means that you can receive guaranteed income payments for as long as you live, ensuring that you never run out of money during retirement.

And unlike other retirement income strategies, an FIA does not require you to sacrifice growth potential for safety. With an FIA, you can benefit from the upside potential of the stock market without exposing your retirement income to market risk.

So, why should you consider an FIA as part of your retirement income plan? Simply put, it provides the peace of mind and financial security that retirees need to enjoy their golden years without worrying about money. With an FIA, you can protect your retirement income from the risk of running out of money, and enjoy the retirement lifestyle that you have always dreamed of.

To get started with an FIA, all you need to do is contact a retirement planning expert like me. I can help you assess your retirement income needs and create a customized plan that includes an FIA. Don’t wait until it’s too late – take control of your retirement income today and enjoy the peace of mind that comes with knowing you are protected from longevity risk.

To sum it up, avoid running out of money during retirement by using an FIA. Protect your retirement income from the risk of sequence of returns, sequential withdrawal, living too long, outliving your retirement income, and stock market losses with an FIA. Contact a retirement planning expert like Mel Gambrell to create a customized plan today. Don’t wait until it’s too late – take control of your retirement income and enjoy the peace of mind that comes with knowing you are protected from longevity risk.

How to Take Portfolio Withdrawals in a Market Downturn

How to Take Portfolio Withdrawals in a Market Downturn

When it comes to investing, market downturns can be nerve-wracking. Investors may become anxious about market volatility and may be tempted to withdraw their portfolio. However, withdrawing your portfolio during a downturn can be a big mistake as it can lead to significant losses. In this article, we will discuss how to take portfolio withdrawals in a market downturn, providing tips and strategies to help investors make informed decisions.

Have a Withdrawal Strategy in Place

If you’re worried about a market downturn, it’s important to have a withdrawal strategy in place. This means having a plan for how much money you will withdraw and when you will do it. Having a plan in place will help you avoid making emotional decisions in the heat of the moment. Consider working with a financial advisor to help create a customized withdrawal strategy based on your goals and risk tolerance.

Rebalance Your Portfolio

During a market downturn, it’s common for some investments to perform better than others. Rebalancing your portfolio will help you stay diversified and minimize losses. Rebalancing involves selling investments that have increased in value and reinvesting the proceeds in investments that have decreased in value. This strategy can help you maintain a balanced portfolio and mitigate risk.

Consider Tax Implications

When withdrawing money from your portfolio during a market downturn, it’s important to consider tax implications. Withdrawals from a traditional IRA or 401(k) are typically subject to income tax, while withdrawals from a Roth IRA are tax-free. Additionally, selling investments at a loss can be used to offset capital gains and potentially lower your tax bill. Consult with a tax professional to help you navigate these complex tax issues.

Focus on Long-Term Goals

It’s important to remember that investing is a long-term strategy. While market downturns can be stressful, it’s important to focus on your long-term goals. Avoid making rash decisions based on short-term market movements, as this can lead to significant losses. Instead, stick to your investment plan and remain disciplined.

In conclusion, taking portfolio withdrawals during a market downturn can be a complex and challenging process. It’s important to have a strategy in place, rebalance your portfolio, consider tax implications, and focus on long-term goals. By following these tips and strategies, investors can make informed decisions and mitigate losses during times of market volatility.

LIRP – The Life Insurance Retirement Plan

Understanding LIRP – The Life Insurance Retirement Plan

The Life Insurance Retirement Plan (LIRP) is a unique financial tool that can help individuals secure their retirement while providing them with protection during their working years. LIRPs are becoming increasingly popular in the financial world as more people recognize the benefits they can offer.

What is a LIRP?

A LIRP is a hybrid financial product that combines the benefits of a traditional life insurance policy with those of a retirement plan. It is a cash value life insurance policy that is designed to provide a stream of tax-free income during retirement.

How does a LIRP work?

The structure of a LIRP is fairly simple. A policyholder buys a life insurance policy, paying a premium each year. The premium payments are invested and grow over time, building up a cash value within the policy.

The cash value can be accessed tax-free through withdrawals or loans during the policyholder’s lifetime. At the time of death, the beneficiaries receive the death benefit, which is typically tax-free as well.

Benefits of a LIRP

One of the primary benefits of a LIRP is the tax-free income it provides during retirement. Unlike traditional retirement plans such as 401(k)s or IRAs, the money withdrawn from a LIRP is not subject to income tax. This can be a significant advantage, particularly for individuals in higher tax brackets.

Another benefit is the flexibility a LIRP can offer. Unlike traditional retirement plans, there are no limits on how much can be contributed each year. This can be particularly beneficial for individuals who have already maxed out their contributions to other retirement plans.

Additionally, LIRPs offer protection against market downturns and other financial risks. The cash value within the policy is guaranteed to grow each year, regardless of market conditions. This can provide peace of mind for individuals who are concerned about the volatility of other investments.

Risks of a LIRP

The potential for the policy to lapse if the policyholder is unable to make the premium payments. If this happens, the policy may lose its tax-free status and the cash value within the policy may be forfeited.

Finally, LIRPs are not for everyone. They are best suited for individuals who are already maxing out their contributions to other retirement plans and who are comfortable with the risks associated with these products.

Conclusion

A LIRP can be a powerful tool for individuals who are looking to secure their retirement while also providing protection during their working years. Like any financial product, it is important to do your research and understand the risks and benefits before making a decision. With the help of a financial advisor, you can determine if a LIRP is the right choice for your retirement plan.