GAMBRELL FINANCIAL NEWS

Whole Life Vs Term & Invest The Difference

In this segment we’ll first take a look at purchasing a Whole Life Insurance Policy on a child age 5 months old.

In this example the goal is to have a $175,000 paid up whole life insurance policy by age 20.

Current retirees are spending an average of 31% of their retirement income on taxes. For most retirees’ taxes will be your largest expense with health care at a close #2! Let us eliminate this tax burden by helping you to achieve the zero percent tax bracket.

TOP-RATED FINANCIAL NEWS

Don’t have time to read, you can listen to our podcast at: https://www.redzonetoolbox.com/

Have a topic you would like more clarity on send us an email: info@gambrellfinancial.com

A unique Whole Life Vs Term & Invest The Difference Scenario

A unique Whole Life Vs Term & Invest The Difference Scenario

In this segment we’ll first take a look at purchasing a Whole Life Insurance Policy on a child age 5 months old.

In this example the goal is to have a $175,000 paid up whole life insurance policy by age 20.

In order to have a $175k paid up policy by age 20, the initial death benefit will need to be $248,817 with a monthly premium of $70.20. The total 20-year premium is $16,848.

This $175,000 paid up whole life insurance policy will also give your child a paid-up long-term care benefits package.

With this particular plan at some point in the future if long term care services were needed, you would be able to access up to 95% of the death benefit for long-term care type services. ($166,250)

If long term care services are needed between the age of 40 – 60 these funds can be used to purchase an asset-based long term care annuity which will 4X the face value of the annuity when accessed for long term care services without paying any taxes on these funds. $166,250 would grow to $665,000 if used for long term care services.

If these funds are needed for long term care services starting at age 70 and older, the multiplier is 2.5X. $166,250 would grow to $415,625 income tax free if used for long-term care services.

Pay $70.20 each month for 20 years and give the gift of lifetime whole life insurance in the amount of $175,000 & give the gift of long-term care benefits totaling up to $665,000!

Often, I hear a pitch about buying term and invest the difference…. A strategy proven not to work for the majority of people, but nonetheless many believe in this strategy like it’s a cult!

Let’s compare a female age 40 who purchases a 250,000!

20-year term for $25.31 per month or $5,833.61 for 20 years.

The rate for the whole life insurance policy in this example is at the standard rate class and the rate for the female age 40 is also at the standard rate class.

Speaking of long term care plans, on Dave Ramseys website he suggests purchasing a long-term care plan at the age of 60.

One point I would like to make is this:

The majority of Americans age 40 and older will not qualify for the best life insurance rates. Many Americans by the time they reach age 40 are taking some kind of prescribed prescription drug. Most will fall in the standard to standard plus rate class.

I hear the commercials just like you do advertising a Male age 45 with xyz health conditions can get approved for a term life insurance policy at the preferred rate. Typically, the plans quoted are a version of a simplified issue term policy which is not a fully underwritten policy, and the premiums will be slightly more even though you are given a preferred rating. A preferred rating for a simplified issue plan is certainly not the same as a preferred rating for a fully underwritten policy.

Also, the lowest of the lowest priced term policies most often don’t provide common place living benefits.

The likelihood of you dying with a 20-year term is less than 3%. The likelihood of your dying with a whole life or permanent life insurance policy is 100%. The likelihood of you experiencing and surviving a critical illness such as a heart attack, stroke, or cancer during the same 20-year term policy is 42% if between the age of 40 and 60!

If the likelihood of you experiencing a critical illness between the age of 40 and 60 is 42%, this tells me, there will be many people who will not qualify for a long-term care policy at age 60 and you don’t have to suffer a critical illness to not qualify for a long-term care plan. If you recently had a hip replacement or needing a hip replacement, you might not qualify for a long-term care plan for obvious reasons and if you do, the premiums will be much higher on an already high-priced long-term care plan. A life insurance policy and a long-term care plan is medically underwritten differently.

On Dave Ramseys website he suggests a female can obtain long-term care coverage starting out at around $2,700 per year. This premium will provide the bare basic coverage of $150 daily benefit for 36 months for a maximum payout of $164,000 for long term care needs.

I noticed this premium was for a female in their 50’s however he suggests waiting until age 60 before purchasing an LTC Plan. Not sure why they didn’t provide an example quote for a female age 60 (which is there recommend purchasing age)

However, let’s assume the price is $2,700 for a female age 60. For this example will assume at age 79, long-term care services are needed.

Most long-term care plans will receive a rate increase after the first 5 years of 20% starting with year 6 and again after another 5 years or so but we’ll assume it doesn’t happen again for 10 years. During the first 5 years the premiums total $13,500. During the next 10 years the premiums total $32,400. Assuming only a 5% rate increase after an additional 5 years, the premiums for the next 4 years is $13,608. After 19 years of paying for long-term coverage for the lowest benefit plan possible without cost-of-living increases…. The total 19-year premium would be $59,508.

Let’s do a real quick recap.

A 20-year term policy costs $5,833.61 a long term care policy to age 79 cost $59,508 for a total insurance cost of $65,341.61

$65,341.61 leaves you with no life insurance coverage and $164,000 of long-term care insurance coverage.

Compare this with purchasing a whole life insurance paid up at age 20. Total premiums paid $16,848.

Total life insurance at age 79 is $175,000. Total benefits available for long-term care services are $166,250.

I think it’s clear to see which path is the better option.

The 20-year paid up whole life insurance policy is by far the best option for you to choose.

BUT WAIT!

Because the whole life insurance pay out option isn’t a reimbursement like the long term care plan is, meaning the long term care plan will reimburse you a daily benefit of $150 while the whole life insurance policy will provide you with a lump sum payout of $166,250 (according to this example).

With this lump sum income tax free payout, we’ll roll this into an asset based long term care annuity with a 2.5X multiplier giving you $415,625 income tax free if used for long-term care services.

Keep in mind, only $16,848 was paid for this policy.

In order for you to match this same benefit payout amount of $415,000 with a long-term care policy, you will certainly dish out some serious cash to the tune of almost $108,000 over 19 years. ($108,000 for 415,000 of LTC coverage is really a low ball estimate, most likely these premiums would reach the $150k range over 19 years)

If you add $108,000 plus the cost of the 20-year term policy, you will have paid $113,833.61 almost $100,000 more than the cost of the 20-year paid up whole life insurance policy with living benefits.

$113,833.61 verse $16,848, I’ll let you decide who the winner is!

If at age 79 instead of needing long-term care services, you die peacefully in your sleep.

Your loved ones will receive nothing by way of the long-term care plan, just copies of receipts totaling $113,833.61 you spent on term and long-term care insurance while the family members of the person who purchased the 20-year paid up whole life insurance will receive $175,000 income tax free!

Once again, I’ll let you decide who the true winner is!

Let’s take a look at investing the difference.

The difference between the whole life insurance premiums and the term life insurance premiums is $11,014.39 or $45.89 monthly for 20 years.

45.89 at 8.12% net of fees but not net of taxes would give you $27,622.45, after accounting for taxes you would be left with $19,335.71.

Once again, I’ll let you decide who the winner is. The buy term and invest the difference person or the person with the 20-year paid up whole life insurance policy.

The 20-year paid up whole life insurance client at the age of 20, is certainly free to invest any difference they want as they no longer have a life insurance premium for the rest of their life.

Or they can invest in a LIRP -Life Insurance Retirement Plan as a way to erase taxes due on their social security income along with potentially erasing the taxes due on their tax deferred 401k /IRA accounts!

I was asked by a 30-year-old female if it was better to leave an inheritance for their loved ones by way of simply investing the difference or using the same money for a permanent life insurance policy such as a whole life insurance policy or similar.

In this example I’ll use a young executive female age 30 purchasing a permanent life insurance policy with a lifetime guaranteed monthly premium of $332.50 versus simply investing $332.50 in a managed brokerage account.

The life insurance death benefit in this scenario is $1.3 Million Dollars.

As stated previously, this plan has a guaranteed premium of $332.50. This premium is guaranteed until age 95.

Let me repeat! As this client gets older the premiums will not increase due to the cost of insurance increasing, the premium is guaranteed until age 95 life expectancy!

Let’s compare a 30-year window of time from age 30 to age 60.

After 30 years the total premium paid is $119,700

If instead you invested this amount over 30 years, the numbers would look like this.

$3,990 Each Year

For 30 years:

9.62% Rate of Return

1.5% Fee

Ending value (net with fees)

$541,100.71

Ending value (gross)

$732,415.91

Cost of fees

$191,315.20

After 30 years of investing the difference, you would realize $541,100.71 net of fees.

If you died after 30 years, your beneficiaries would realize $351,716 after taxes assuming 35% of this money is lost to taxes, legal fees and probate!

If after 30 years you died with the $1,300,000 life insurance policy in place, your beneficiaries would receive $1,300,000 income tax free.

Are your loved ones better off receiving $351,716 or $1,300,000 from the life insurance policy?

For this example, if you were looking to maximize how much money you can leave to your loved ones… you could pass on almost $1,000,000 more than what you can investing the same amount of money over 30 years.

I think it’s a safe assumption to assume most would rather receive the $1.3 Million income tax free life insurance benefits instead of the after tax $351,716 from your investment accounts.

I already know what some of you might be thinking…. What about the term life insurance plan?

It’s important to note that advocates of buy term and invest the rest, only recommend term lengths of 20 years or less. As mentioned previously, less than 3% of all term polices will have a death claim filled against it! There’s a 97% chance you will not die during the term of your term life insurance policy.

Let’s view some of the extra benefits you can receive from this particular guaranteed life insurance policy.

I started off this segment explaining the details of a whole life insurance policy with living benefits to include a 95% lump sum payout in the event of a chronic illness (long term care).

The $1,300,000 life insurance plan used in this current example is a little different.

The first plan (20 year paid up whole life insurance policy) pays for long-term care benefits (chronic illness) along with 5 Critical illnesses and a terminal illness benefit.

The $1,300,000 life insurance plan pays for the same long-term care benefits / (chronic illness) along with “16” Critical illnesses and a terminal illness benefit.

With a $1.3 million policy, if you needed long-term care services, the policy would provide you with a lump sum payout of just over 1 million dollars income tax free.

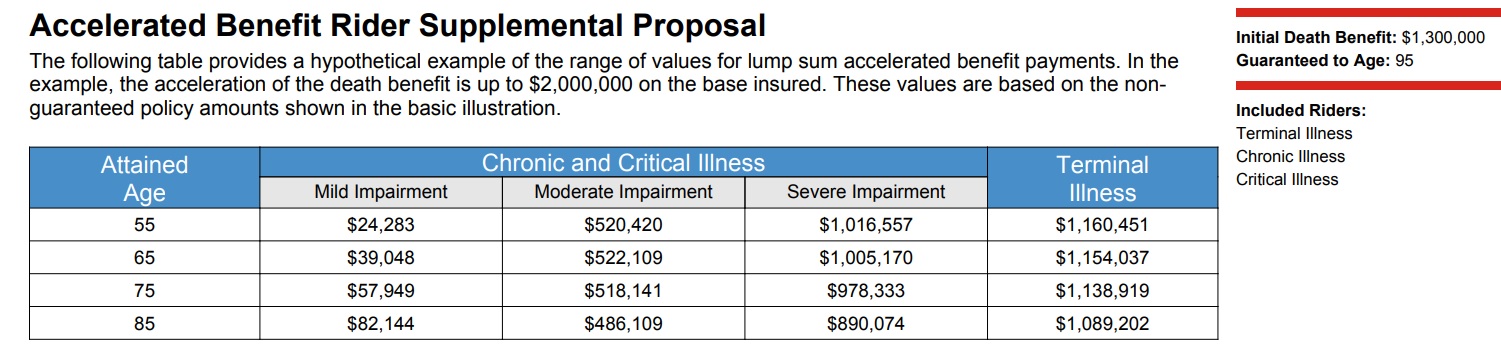

You can view the image to the left or at the top of this segment to view the payout schedule.

If you became ill with a major heart attack, stroke, cancer or 13 other critical illnesses, the plan would provide you with a payout just of over 1 million dollars.

The critical illnesses this plan would provide you with a lump sum payout for is this: Heart Attack, Stroke, End-Stage Renal Failure, Invasive Cancer, Major Organ Transplant, ALS, Paralysis, Arterial Aneurysms, Blindness, Central Nervous System Tumors, Major Multi-System Trauma, Aids, Severe Disease Of Any Organ, Severe Central Nervous System Disease, Major Burns, Loss Of Limbs.

If you suffer any of these critical illnesses, you could receive a lump sum benefit of 1 million dollars.

The next benefit of this plan is the terminal illness benefit. If a licensed medical professional determines you have 24 months or less to live, you’ll gain access to just over 1 million dollars income tax fee.

With all 3 scenarios, the Long-Term Care or Chronic Illness benefit, the Critical Illness Benefit and the Terminal Illness benefit….. The “Income Tax Free” lump sum payout you receive is yours to spend however you like!

If you want to go on an extended vacation or a large family vacation, you can. If you want to payoff your mortgage you can. If you want to become 100% debt free you can. If you recovered from a major heart attack and decide to retire early or start a new business, you can.

The bottom line is this: The money is yours to spend how you see fit!

Many terminally ill clients like the flexibility of receiving a large portion of their death benefit before they pass. Having the ability to give their grandchildren or other loved ones a financial gift before they pass away instead of after the pass away…… is priceless! This scenario give you the ability to create lifelong memories with those you love the most.

Let’s look at our last example of how this plan could be used.

Using the same female age 30 in good health with a $1,300,000 permanent life insurance plan with the above living benefits and at age 60 suffers a major heart attack but survives.

Our client receives $1,016,557 Lump Sum Cash from the insurance policy. Client decides to retire 5 years early after having a severe heart attack.

The client keeps $400,000 cash to pay for out-of-pocket medical expenses and to replace his income for 5 years until age 65 when he’ll tap into his 401k account for retirement and potentially tap into his Social Security.

The remaining lump sum cash benefit of $616,557 is put into an Fixed Income Annuity for 10 years.

At age 70 she turns on the guaranteed income stream of $116,184.51

If she lives 20 years beyond age 70, the total payout would be over two million dollars $2,323,690.20 based on todays current rates.

Stack up all of these benefits versus simply investing the difference and I think it’s very clear which scenario is the winner!

For many people the catch phrase “Buy Term & Invest The Difference” sounds really cool, however after accounting for when “Life Happens” the reality is it might not be so cool after all!

In our example above if you died after 30 years, the term life insurance policy will have already expired and the only thing you would be left with is the 10-year-old bank statements showing how much you paid for the term insurance over 20 years. These bank statements will be the only thing you have to remind your family members about the term life insurance policy that expired 10 years earlier.

Don’t leave your family members old receipts from a life insurance policy you let expire!

The Images above if on a mobile device or to the left if on a computer…. are snapshots of the life insurance quotes I used in this example along with the investment calculator and numbers I used for this example!

Max Funded Policy Design: Step 1. The first step could be the most important step.

If you’ve been following along with my other segments I’ve talked about when using a cash value life insurance policy, it’s vital the plan is structured properly day one.

If you purchase a plan that is not structured properly from day one and three years down the road you realize the mistake, there’s nothing you can do to correct it. Your only option is to start a new plan and that’s why it’s important you work with a qualified financial professional who understands how to create a properly structured cash value life insurance policy!

My recommended product is an IUL – Index Universal Life!

If you would like a detailed explanation on why I recommend an IUL instead of a Whole Life policy, please check out my segment on “IUL Mysteries, Truths & Myths explained!

Basically, you have two primary objectives in purchasing a life insurance plan…. objective number one is to purchase as much life insurance death benefit as you can for a set amount of dollars to pass on to your beneficiary’s income tax free.

Objective #2 is to pay as much money as you can for the least amount of life insurance death benefit, in this scenario you are not concerned with the death benefit. Your primary goal is to maximize tax free income distributions during retirement.

The following example assumes your primary goal is for the cash value accumulation!

This segment is only covering the initial foundation of a properly structured policy.

When I conduct a policy review one of the first hints I see as to whether a policy is designed correctly is the premium to death benefit ratio.

Usually when I see a large premium with a large death benefit, I automatically assume the owner of this plan was looking for the maximum death benefit he or she could buy and the goal was not cash value accumulation.

Let’s look at two policies with the same annual premium of $900. Premium payments for both plans will end after 20 years when the grandchild is age 20.

The age of the insured is 5 months old.

A grandparent wants to give their grandchild the gift of financial stability by way of a max funded life insurance plan.

With the first cash value policy the death benefit is $287,539 with a $75 monthly premium.

The second policy has a death benefit of $51,108 with a $75 monthly premium.

For the client who doesn’t understand how this process works and for the insurance agent or advisor who doesn’t understand how this process works….. You might think paying $75 per month for a $287,539 policy is the way to go.

The agent or advisor runs the numbers and presents you with the proposal showing a total tax-free income payout of $332,500 spread over 35 years starting at age 66-101! Great news Mr. or Mrs. client with this plan you’ll only pay $900 a year for 20 years totaling $18,000 and your grandchild will receive $9,500 of income tax free money. This income stream will last for 35 years totaling $332,500!

Pay $900 per month starting at 5 months old stopping the payments at age 20 and allow these funds to grow untouched for 45 more years and get back $332,500, doesn’t sound to bad right. $18,000 for $332,500!

What if you spend the same $18,000 over 20 years allowing the funds to grow untouched for 45 more years, but instead of a $332,500 return you have a $1,475,830 return without spending a dime more!

In the first scenario beginning at age 66 your grandchild could receive income tax free distributions of $9,500 each year for 35 years while in the second scenario beginning at age 66 your grandchild could receive income tax free distributions of $42,166 each year for 35 years totaling $1,475,830!

Clearly the policy design in the first scenario wasn’t structured for maximum cash value growth.

Here’s why:

Take a look at scenario 1 policy values below:

Client Details res smith, Female, 0, North Carolina

Initial Death Benefit $287,539.00

Initial Premium $900.00

Minimum Premium $787.86

Target Premium $900.00

Guideline Single Premium $19,513.89

Guideline Level Premium $4,714.93

7 Pay Premium $8,373.75

Riders At No Cost*

Riders Accelerated Benefit Rider –

Terminal Illness Accelerated Benefit Rider –

Chronic Illness Accelerated Benefit Rider –

Critical Illness

Over loan Protection Rider.

Income starting at age 66 to age 101: $9,500.00 each year for 35 years for a total of ($332,500)

Account Value at age 66: $249,088.87

Surrender Value at age 66: $249,088.87

Death Benefit at age 66: $536,627.87

The larger the death benefit the higher the fees in relation to the monthly premium!

The death benefit is $287,539 the target premium is $75 monthly. If you were trying to get the maximum amount of permanent life insurance $75 could buy, this plan would be an awesome deal and it would also provide you with some cash value accumulation.

The goal of a max funded cash value policy is not about how large the death benefit is.

We need to reduce the policy fees by getting rid over every dollar of life insurance death benefit the IRS will allow.

Following IRS guidelines, we can reduce the death benefit down to just $51,108 and still be allowed to pay $75 per month.

This reduces the overall fees of the policy and allows more of your money to grow income tax free.

The $75 monthly premium for $287,000 of death benefit is the target premium (the premium needed to keep the policy in force).

The target premium for a death benefit of $51,108 is just $13.33 per month however the max funded premium is $75 per month.

With option one we are paying $75 per month for $287,000 of life insurance and in option two we are paying $75 per month for just $51,000 of life insurance.

Obviously, the fees for option one is almost 6X more than option two.

Client Details res smith, Female, 0, North Carolina

Initial Death Benefit $51,108

Initial Premium $900.00

Minimum Premium $242.76

Target Premium $159.97

Guideline Single Premium $5,161.14

Guideline Level Premium $900.01

7 Pay Premium $1,488.37

Riders At No Cost*

Riders Accelerated Benefit Rider –

Terminal Illness Accelerated Benefit Rider –

Chronic Illness Accelerated Benefit Rider –

Critical Illness

Over loan Protection Rider.

Income starting at age 66 to age 101: $42,166.56 each year for 35 years (1,475,829.60)

Account Value at age 66: $623,896.69

Surrender Value at age 66: $608,237.21

Death Benefit at age 66: $726,777.59

This first process of properly structuring your cash value life insurance plan is vitally important to the overall success of the plan. Get this part wrong and it could cost you thousands.

If you figure out 5 years later too much of your money is going towards paying for the cost of insurance instead of your cash accumulation buckets… Most people will call the insurance company and ask them to reduce the death benefit to the bare minimum.

The problem with this is… the fees are calculated based on the original design of the policy and can not be changed. Yes, you can lower your death benefit, but you will not lower the fees. Also, by lowering the death benefit 5 years later you could also restart the surrender charge period.

As I mentioned previously the only real way to fix a poor design is to start a new plan!

How you start the plan will help to determine how you’ll end the plan.

If you are viewing this segment from a mobile device you can view the policy details used in this example as images above or if on a computer these images are available to you on the left!

If you have a cash value policy and not sure if its structured the right way, email us a copy of your policy and we’ll review it at no cost or obligation to you! info@gambrellfinancial.com

Please check out my segment on “IUL Mysteries, Truths & Myths Explained for more details on how to properly structure a cash value life insurance policy for maximum cash value growth!

Grandparents & Parents…. For less than $38 per month you could potentially provide your children with a half million of tax free income! I’m sure you’ll end up spending way more than an average of $38 dollars a month on fancy cloths, Nikes, smart phones and more. Supplement your spending with a $38 max funded IUL policy to age 20!