GAMBRELL FINANCIAL NEWS

We Don’t Give The Right Gifts!

CNBC personal finance report showed Grandparents spend $179 billion annually on their grandkids an average of almost $2,600 each year per grandchild!

Instead of spending an average of $2,600 each year on gifts that will eventually vanish away why not give the gift of financial stability instead.

TOP-RATED FINANCIAL NEWS

Don’t have time to read, you can listen to our podcast at: https://www.redzonetoolbox.com/

Have a topic you would like more clarity on send us an email: [email protected]

We Don’t Give The Right Gifts!

A, CNBC personal finance report showed Grandparents spend $179 billion annually on their grandkids an average of almost $2,600 each year per grandchild!

https://www.cnbc.com/2019/04/10/grandparents-spend-179-billion-annually-on-their-grandkids.html

Instead of spending an average of $2,600 each year on gifts that will eventually vanish away why not give the gift of financial stability instead.

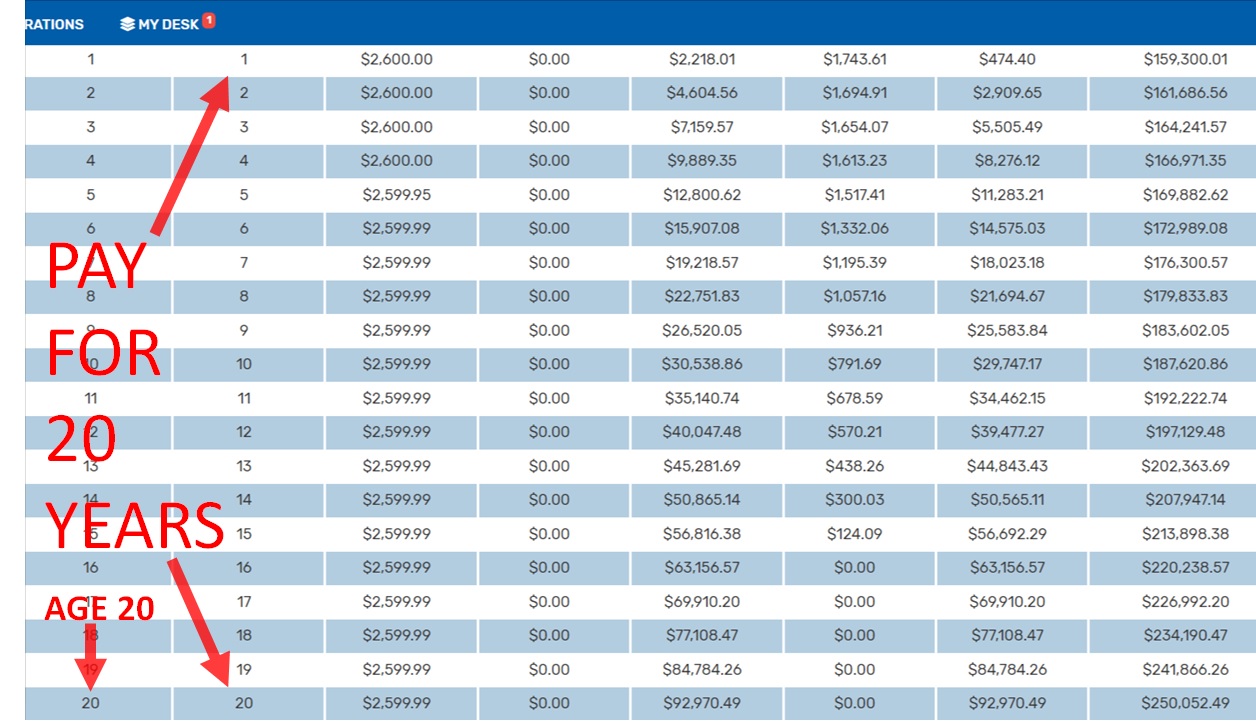

If grandparents instead purchased a properly structured life insurance policy for $2,600 a year when their grandchild turns 5 months old … and pay on this policy for only 20 years…. then allow the account to grow untouched until their grandchild turned 65, they would be able to provide that grandchild with almost $4 million dollars of income tax free money.

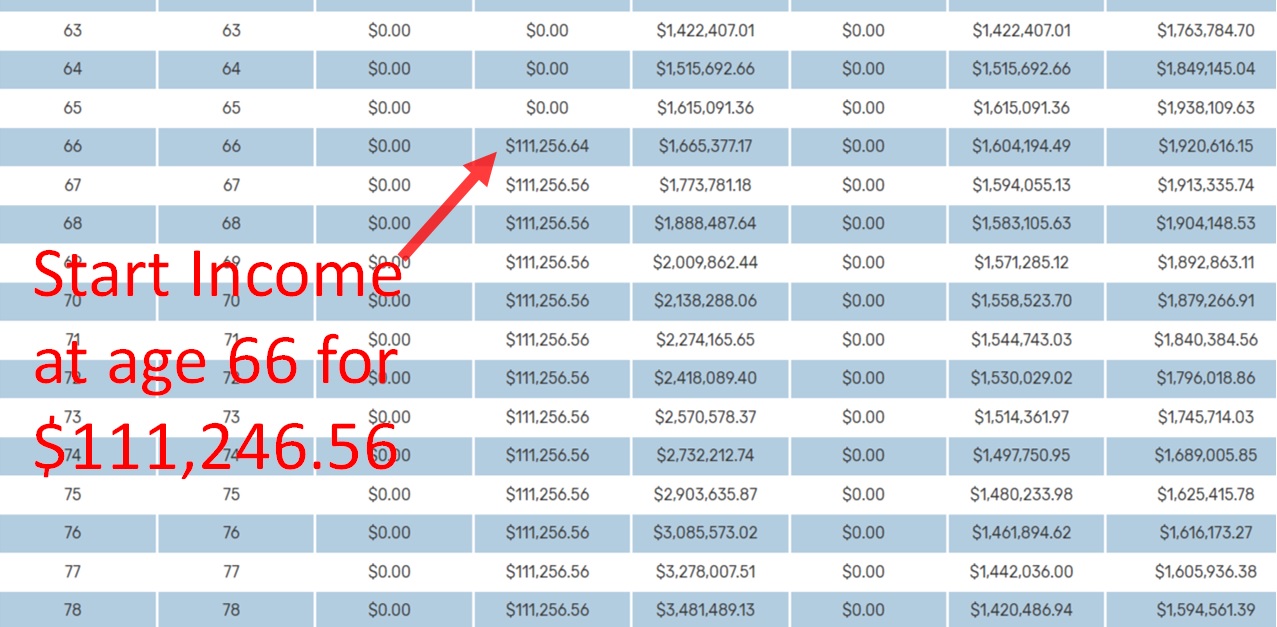

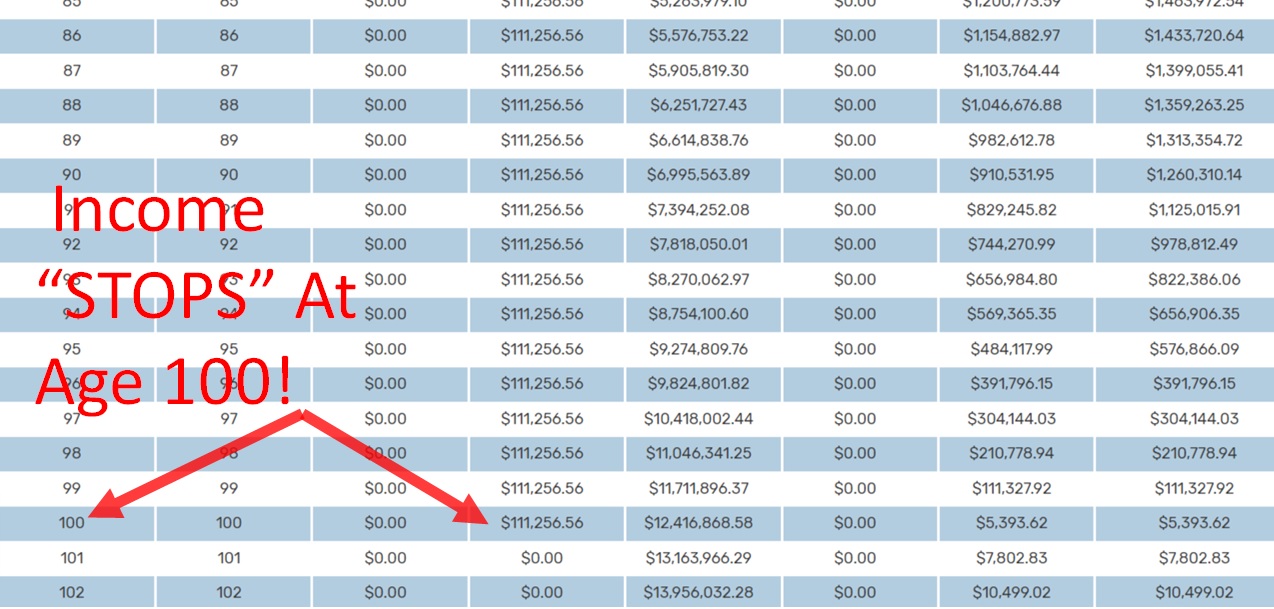

$111,256.56 each year for 35 years income tax-free!

Here’s how it works!

The grandparent or parent pays on this policy for just 20 years until the child turns age 20 and the policy will be paid up for the rest of their life allowing this policy to sit 45 more years untouched.

At age 65 turn this income stream on and enjoy almost $4 million income tax free.

Now I get it, purchasing a tangible gift for your grandchild does provide grandparents a lot of joy, pride and satisfaction… I get it, you don’t have to spend the entire $2,600 per year on a financial gift why not spend at least a portion of it, maybe 25%!

Spending 25% of $2,600 per year could still potentially provide your grandchild with almost a million dollars later on in life…..While also providing your grandchild with a paid up life insurance policy they’re not making payments on and providing your grandchild with a paid up long-term care policy and providing your grandchild with a paid up critical illness policy and providing your grandchild with a paid up terminal illness policy all at the same time.

Keep in mind the ultimate goal would be to allow this plan to sit for 65 years untouched while funding the policy for the first 20 years, however if at age 50 they need to access these funds to purchase a home or to pay off a home or to pay off a car or to pay off student loan debts or to change careers and start a new business they would have the Financial means to do so.

The next time you decide to purchase your grandchild a gift think about potentially holding back at least 25% of what you were already going to spend and putting it into an account potentially providing your grandchild with millions later on in life.

Give the gift of a properly structured 20 year paid up cash value life insurance policy.

If interested in setting up a plane like this for your child or grandchild contact our office today.

[email protected] Mel Gambrell